Fed Chair Powell Speaks & Leading Economic Indicators

Fed Chair Powell delivered a dovish speech on Friday, making it clear that a rate cut is coming.

FED CHAIR POWELL SPEAKS IN JACKSON HOLE, WY

Federal Reserve Chair Jerome Powell delivered a dovish speech in Jackson Hole, Wyoming on Friday. Powell all but promised rate cuts are coming soon, most likely at the September 17 & 18 FOMC meeting. The September meeting will also provide FOMC members an opportunity to update the Summary of Economic Projections, which was last published at the June 2024 meeting.

Here is what Chair Powell had to say about monetary policy:

Near-Term Outlook for Policy

Let's begin with the current situation and the near-term outlook for policy.For much of the past three years, inflation ran well above our 2 percent goal, and labor market conditions were extremely tight. The Federal Open Market Committee's (FOMC) primary focus has been on bringing down inflation, and appropriately so. Prior to this episode, most Americans alive today had not experienced the pain of high inflation for a sustained period. Inflation brought substantial hardship, especially for those least able to meet the higher costs of essentials like food, housing, and transportation. High inflation triggered stress and a sense of unfairness that linger today.1

Our restrictive monetary policy helped restore balance between aggregate supply and demand, easing inflationary pressures and ensuring that inflation expectations remained well anchored. Inflation is now much closer to our objective, with prices having risen 2.5 percent over the past 12 months (figure 1).2 After a pause earlier this year, progress toward our 2 percent objective has resumed. My confidence has grown that inflation is on a sustainable path back to 2 percent.

Turning to employment, in the years just prior to the pandemic, we saw the significant benefits to society that can come from a long period of strong labor market conditions: low unemployment, high participation, historically low racial employment gaps, and, with inflation low and stable, healthy real wage gains that were increasingly concentrated among those with lower incomes.3

Today, the labor market has cooled considerably from its formerly overheated state. The unemployment rate began to rise over a year ago and is now at 4.3 percent—still low by historical standards, but almost a full percentage point above its level in early 2023 (figure 2). Most of that increase has come over the past six months. So far, rising unemployment has not been the result of elevated layoffs, as is typically the case in an economic downturn. Rather, the increase mainly reflects a substantial increase in the supply of workers and a slowdown from the previously frantic pace of hiring. Even so, the cooling in labor market conditions is unmistakable. Job gains remain solid but have slowed this year.4 Job vacancies have fallen, and the ratio of vacancies to unemployment has returned to its pre-pandemic range. The hiring and quits rates are now below the levels that prevailed in 2018 and 2019. Nominal wage gains have moderated. All told, labor market conditions are now less tight than just before the pandemic in 2019—a year when inflation ran below 2 percent. It seems unlikely that the labor market will be a source of elevated inflationary pressures anytime soon. We do not seek or welcome further cooling in labor market conditions.

Overall, the economy continues to grow at a solid pace. But the inflation and labor market data show an evolving situation. The upside risks to inflation have diminished. And the downside risks to employment have increased. As we highlighted in our last FOMC statement, we are attentive to the risks to both sides of our dual mandate.

The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.

We will do everything we can to support a strong labor market as we make further progress toward price stability. With an appropriate dialing back of policy restraint, there is good reason to think that the economy will get back to 2 percent inflation while maintaining a strong labor market. The current level of our policy rate gives us ample room to respond to any risks we may face, including the risk of unwelcome further weakening in labor market conditions.

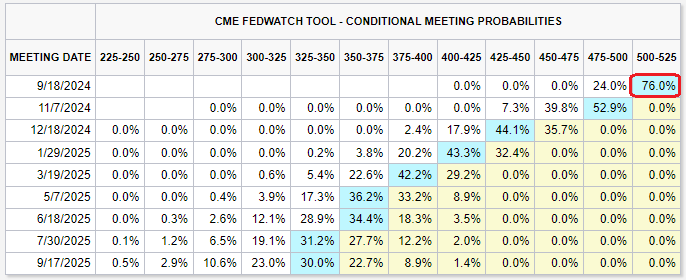

Market participants anticipate a 25 basis point rate cut in September. We think a quarter-point rate cut is the most likely outcome; however, a weaker-than-expected employment report before the September FOMC meeting may result in a 50 basis point rate cut. Chair Powell is closely watching for weakness in the labor market. Here are the current CME FedWatch Tool probabilities:

LEADING ECONOMIC INDICATORS :: JULY 2024

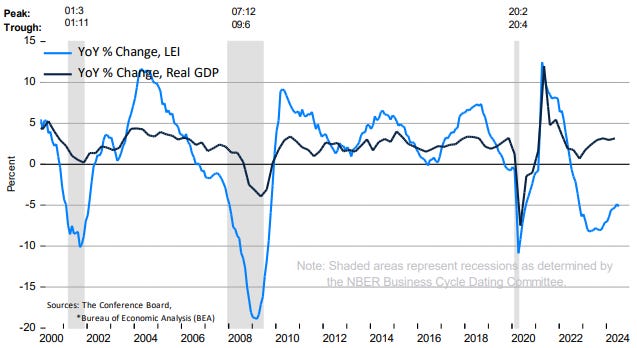

The Conference Board Leading Economic Index® (LEI) decreased by 0.6% in July, following a 0.2% decline in June. During the six-month period ending in July, the LEI contracted by 2.1%, slightly better than the 3.1% decline observed in the previous six-month period. While the LEI continues to decrease, the pace of the decline is slowing. Despite the ongoing contraction in the LEI, The Conference Board forecasts slow economic growth, not a recession. Current GDP growth projections for the third quarter of 2024 vary: the Atlanta Fed's GDPNow model estimates 2.0% real GDP growth, while the New York Fed's Nowcast predicts 1.9% growth.

“In July, weakness was widespread among non-financial components. A sharp deterioration in new orders, persistently weak consumer expectations of business conditions, and softer building permits and hours worked in manufacturing drove the decline, together with the still-negative yield spread. These data continue to suggest headwinds in economic growth going forward.”

-Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board

Source: The Conference Board

Source: The Conference Board

The Coincident Economic Index® (CEI), which gauges present economic conditions, was unchanged in July, following a 0.2% increase in June. From February through July, the CEI rose 0.9%, faster than the 0.5% growth rate observed in the previous six months. Three of the four CEI components increased in July.

NOTES

We are saddened to share that Bob (Sr) passed away last week.

We plan to publish our September Model Portfolio Update next weekend on September 1st. You can read our most recent August Update here.