FOMC Meeting & Leading Economic Indicators

There is no change to the federal funds target rate. The LEI declined for the seventeenth consecutive month.

FEDERAL OPEN MARKET COMMITTEE

The Federal Open Market Committee (FOMC) voted unanimously to keep the federal funds target range unchanged at 5.25% to 5.5%. In the post-meeting statement, FOMC members noted that the labor market remains strong and inflation remains elevated. Below is the full FOMC statement:

This week’s FOMC meeting provided members with an opportunity to share their latest economic projections published in the Summary of Economic Projections (SEP). The table below shows the central tendency of those projections, which excludes the three highest and three lowest projections for each variable in December of each year. For December 2023, real GDP estimates were revised about 1% higher, the unemployment rate was revised lower, the PCE inflation forecast increased slightly, and the core-PCE inflation decreased slightly. The federal funds target rate projection was unchanged for 2023, with most FOMC members expecting one more rate hike this year. The December 2024 fed funds rate forecast increased one-quarter percent.

The dotplot shows each FOMC member’s forecast for the federal funds rate at year-end. In our graphic below, we show the December 2023, 2024, and 2025 dots as well as the Fed’s longer-term estimate. According to the new dot plot, twelve FOMC members expect one more rate hike this year and seven FOMC members believe rates will remain at their current level through year-end. The dots for December 2024 are dispersed but most of the forecasts in December 2024 are lower than their current level. Only one dot is higher in 2024 than in 2023.

Following the FOMC meeting, Fed Chair Powell conducted a press conference. You can read a PDF Transcript or watch it here:

The next FOMC meeting is scheduled for October 31st and November 1st. The policy decision at the meeting will primarily depend upon the incoming inflation data between now and then. If the inflation data continues its recent disinflationary trend, another ‘skip’ is likely. However, if the inflation reaccelerates over the coming weeks, a rate hike cannot be ruled out. The Fed was careful this week to continue to keep one more rate hike in their forecast this year.

LEADING ECONOMIC INDICATORS :: AUGUST 2023

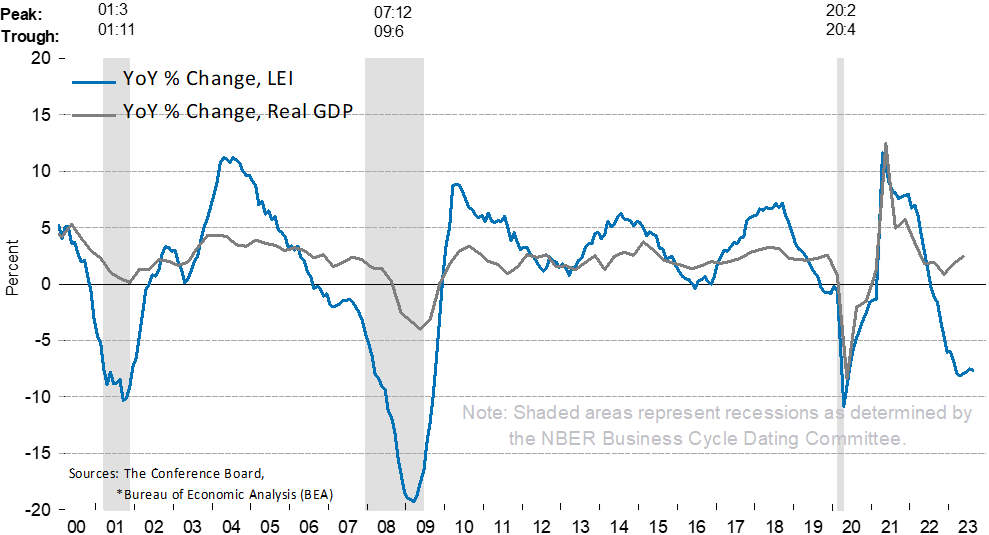

In August 2023, the Conference Board Leading Economic Index® (LEI) fell 0.4%, following a 0.3% decline in July. August marked the seventeenth consecutive decline in the index. During the six-month period from February 2023 through August 2023, the LEI declined by 3.8%, similar to the 3.9% drop observed in the previous six-month period. Four of the ten LEI components advanced during the most recent six-month period through August.

“The leading index continued to be negatively impacted in August by weak new orders, deteriorating consumer expectations of business conditions, high interest rates, and tight credit conditions. All these factors suggest that going forward economic activity probably will decelerate and experience a brief but mild contraction. The Conference Board forecasts real GDP will grow by 2.2 percent in 2023, and then fall to 0.8 percent in 2024.”

-Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board

Source: The Conference Board

Source: The Conference Board

The Coincident Economic Index® (CEI), a measure of current economic activity, edged 0.2% higher in August, after a 0.3% increase reading in July. Looking at the six-month period between February 2023 and August 2023, the CEI rose 0.8%, picking up from the 0.5% pace experienced in the preceding six-month period. Strength within the CEI components was widespread with all four components increasing.

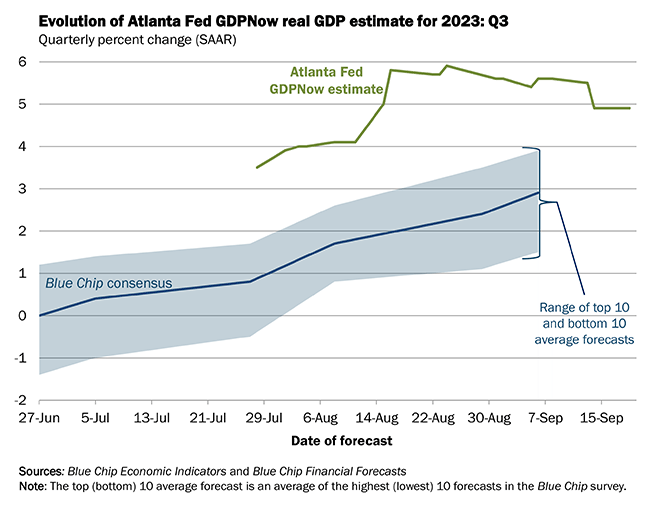

GDP :: Q3 UPDATE

The ongoing recovery in the services economy continues to outweigh the recessionary signals emanating from the goods economy. The Atlanta Fed GDPNow is estimating third-quarter real GDP growth of 4.9%.