Gross Domestic Product + Inflation Update

Fourth quarter real GDP +3.3%. Headline PCE inflation +2.6% and core PCE inflation +2.9% in December.

GROSS DOMESTIC PRODUCT (GDP)

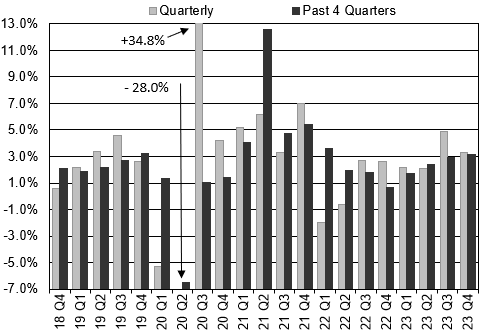

Real gross domestic product (GDP) increased at a 3.3% annual rate in the fourth quarter of 2023, following a 4.9% real GDP growth rate in the third quarter. Real GDP increased 2.5% in calendar year 2023, up from a 1.9% increase in 2022. The 2.5% increase was slightly higher than our trend growth estimate of 2.0%.

Personal consumption expenditures (consumer spending) are the most important component within the GDP report, representing nearly 70% of GDP. During the fourth quarter, PCEs contributed 1.9% to the overall 3.3% GDP figure, down slightly from a 2.1% contribution in the third quarter. Gross private investment contributed 0.4%. Net exports added 0.4% and government consumption expenditures added 0.6%. View a more detailed real GDP contribution breakdown in Table 2 of the report.

INFLATION UPDATE

The personal consumption expenditure (PCE) inflation report showed the PCE price index increased 0.2% during December. The core PCE, which excludes the food and energy components, also rose 0.2% during the month.

The pace of headline PCE inflation peaked at 7.1% year-over-year in June 2022 and has decelerated to 2.6%. The core PCE rate, which excludes food and energy prices, peaked at 5.6% in February 2022 and has decelerated to 2.9%. The six-month headline and core PCE inflation rate is currently at the Fed’s stated 2.0% inflation target which should please FOMC members. This sets the stage for a 25 basis point rate cut at either the March or the May FOMC meeting.

Headline PCE:

+0.2% seasonally adjusted in December, following -0.1% in November

+2.6% year-over-year

+0.5% latest 3 months annualized

+2.0% latest 6 months annualized

Core PCE: (excludes food and energy)

+0.2% seasonally adjusted in December, following +0.1% in November

+2.9% year-over-year

+1.5% latest 3 months annualized

+1.9% latest 6 months annualized

Long-Term Chart of Headline and Core PCE Inflation (Year over Year Change)

Summary Tables from BEA.gov PCE report: