Leading Economic Indicators

May 2023

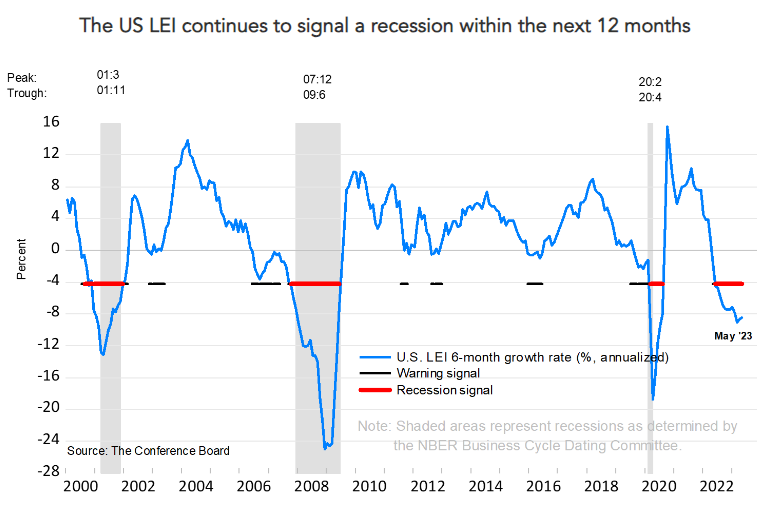

In May 2023, the Conference Board Leading Economic Index® (LEI) experienced a 0.7% decrease, following a 0.6% decline in April. This decline marks the fourteenth consecutive monthly decrease in the index. From November 2022 to May 2023, the LEI declined by 4.3%, slightly faster than the 3.8% drop observed in the previous six-month period. In May, four of the ten LEI indicators showed an increase, namely building permits, average weekly initial claims for unemployment, stock prices, and manufacturers' new orders for consumer goods.

“While we revised our Q2 GDP forecast from negative to slight growth, we project that the US economy will contract over the Q3 2023 to Q1 2024 period. The recession likely will be due to continued tightness in monetary policy and lower government spending."

-Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board

Source: The Conference Board

Source: The Conference Board

The Coincident Economic Index® (CEI) increased 0.2% in May, continuing the growth trend observed in April, which showed a 0.3% increase. Looking at the six-month period between November 2022 and May 2023, the CEI rose 0.8%, slightly lower than the 0.9% growth experienced in the preceding six-month period. Three of the four CEI components advanced during the past six months.

The Federal Open Market Committee (FOMC) is scheduled to meet on July 25th and 26th. This week Fed Chair Powell delivered the semi-annual Monetary Policy Report to Congress. In his remarks, Chair Powell noted that “Nearly all FOMC participants expect that it will be appropriate to raise interest rates somewhat further by the end of the year. But at last week's meeting, considering how far and how fast we have moved, we judged it prudent to hold the target range steady to allow the Committee to assess additional information and its implications for monetary policy”.

Market participants have gotten the message and are now pricing a 77% probability of a quarter-point rate hike at the upcoming July FOMC meeting, lifting the fed funds target range to 5.25% - 5.5%.

This week’s comments from Chair Powell reiterated our observations following the most recent FOMC meeting, which showed that “most FOMC members expect two more rate hikes over the next four FOMC meetings”. Although the upcoming monetary policy decisions are going to be data-dependent, most members expect the incoming economic data to support additional policy tightening.

Fidelity is currently offering treasuries in the 3, 6, 9, month and one year duration all over 5.3%

Thanks for the update. Treasuries look to be the best investment for cash in 2023. DH