Leading Economic Indicators

The Leading Economic Index slipped 0.1% in December.

LEADING ECONOMIC INDICATORS :: DECEMBER 2023

The Conference Board Leading Economic Index® (LEI) showed a 0.1% decline in December, following a 0.5% drop in November. Over the six months from June 2023 to December 2023, the LEI contracted by 2.9%, an improvement from the 4.3% decline in the previous six-month period. Six of ten LEI components were positive in December, an improvement from last month. As has been the case for some time now, the weak readings in the LEI are primarily driven by the ongoing slump in the manufacturing sector.

“As the magnitude of monthly declines has lessened, the LEI’s six-month and twelve-month growth rates have turned upward but remain negative, continuing to signal the risk of recession ahead. Overall, we expect GDP growth to turn negative in Q2 and Q3 of 2024 but begin to recover late in the year.”

-Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board

Source: The Conference Board

Source: The Conference Board

The Coincident Economic Index® (CEI), which gauges present economic conditions, increased by 0.2% in December. From June to December, the CEI rose 1.1%, an acceleration from the 0.8% growth observed in the previous six months. This growth was broad-based, as all four components of the CEI showed an uptick in December.

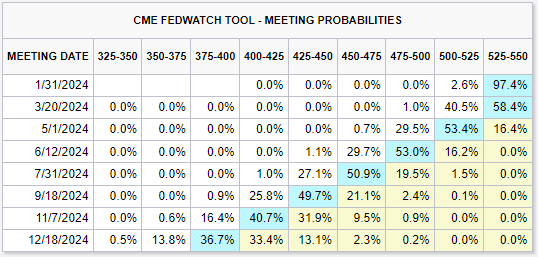

FEDERAL RESERVE UPDATE

The next Federal Open Market Committee (FOMC) meeting is scheduled for January 30th and 31st. We do not expect any change in monetary policy at the January FOMC meeting. According to the CME FedWatch Tool, investors are pricing in a 42% probability of a fed rate cut by the March 20th FOMC meeting and an 84% probability of a rate cut by the May 1st FOMC meeting. Fed Governor Waller’s speech last week indicated the incoming inflation data and revisions to prior CPI data will be very important to him in determining the timing of interest rate cuts. If the inflation data remains roughly in line with current trends, rate cuts are expected to commence at the upcoming March and/or May FOMC meeting.

One piece of data I will be watching closely is the scheduled revisions to CPI inflation due next month. Recall that a year ago, when it looked like inflation was coming down quickly, the annual update to the seasonal factors erased those gains. In mid-February, we will get the January CPI report and revisions for 2023, potentially changing the picture on inflation. My hope is that the revisions confirm the progress we have seen, but good policy is based on data and not hope.

-Fed Governor Christopher Waller (speech 1/16/2024)