Leading Economic Indicators

April 2023

In April, the Conference Board Leading Economic Index® (LEI) experienced a 0.6% decrease, continuing the downward trend from the preceding month with a 1.2% decline in March. This decline in April marked the thirteenth consecutive monthly decrease in the index. Comparing the six-month period from October 2022 to April 2023 to the previous six-month period, the LEI showed a decline of 4.4% as opposed to a 3.8% decrease. Nearly all LEI components witnessed a fall, with only two exceptions: stock prices and manufacturers' new orders for consumer goods.

“LEI continues to warn of an economic downturn this year. The Conference Board forecasts a contraction of economic activity starting in Q2 leading to a mild recession by mid-2023"

-Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board

Source: The Conference Board

Source: The Conference Board

In April, the Coincident Economic Index® (CEI) showed a 0.3% increase, building on the 0.2% growth observed in March. Over the preceding six-month period, the CEI demonstrated a 0.7% rise. However, this increase was slightly lower compared to the 0.9% growth experienced in the previous six-month period.

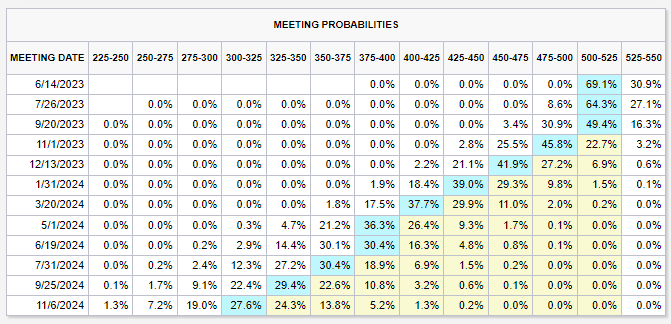

The upcoming Federal Open Market Committee (FOMC) meeting is scheduled to take place on June 13th and 14th, four weeks from now. Based on the latest CME FedWatch data, there is a high likelihood of a pause at this forthcoming FOMC meeting. As of the time of writing, the probability of no change in the fed funds rate stands at 69%, while there is a 31% probability of a 25 basis point rate hike. It is still premature to dismiss the possibility of a rate hike at the June meeting, as the chances of such an increase have been gradually increasing over the past ten days.

Given this evolving situation, it is essential to closely monitor the comments of FOMC members in the coming weeks. Their statements may have an impact on market expectations, potentially influencing the probability of another rate hike in June. However, it is important to acknowledge that the ongoing debt ceiling negotiations could also impact the feasibility of a rate hike during that month. It is highly unlikely that the debt ceiling will not be raised, as such an event would have unprecedented and severe consequences. The 2024 fiscal budget year begins October 1st, so a new fiscal spending bill will need to be agreed to in the coming months. We think a temporary debt ceiling extension through September 30th remains the most likely path forward. This will allow all parties to negotiate a 2024 fiscal spending package and adjust the debt ceiling to finance it.