LEI :: HMI :: FOMC

LEI declines for the 18th consecutive month. HMI drops due to higher mortgage rates. Powell says restrictive monetary policy is working.

LEADING ECONOMIC INDICATORS :: SEPTEMBER 2023

The Conference Board Leading Economic Index® (LEI) fell 0.7% in September following a 0.5% decline in August. It was the eighteenth consecutive decline in the index. During the six-month period from March 2023 through September 2023, the LEI declined by 3.4%, a bit better than the 4.6% drop observed in the previous six-month period. Of the ten LEI components, just one made a positive contribution to the index in September. The nine other LEI components were either flat or negative during the month.

“So far, the US economy has shown considerable resilience despite pressures from rising interest rates and high inflation. Nonetheless, The Conference Board forecasts that this trend will not be sustained for much longer, and a shallow recession is likely in the first half of 2024.”

-Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board

Source: The Conference Board

Source: The Conference Board

The Coincident Economic Index® (CEI), a measure of current economic activity, edged 0.3% higher in September, after a 0.1% increase reading in August. Looking at the six-month period between March 2023 and September 2023, the CEI rose 1.1%, accelerating from the 0.4% pace during the preceding six-month period. All four CEI components increased in September.

NAHB/WELLS FARGO HOUSING MARKET INDEX

The NAHB/Wells Fargo Housing Market Index (HMI) fell four points in October to 40, the third consecutive monthly decline. Mortgage rates jumping to levels not seen in more than two decades are the cause. Builder confidence is now at its lowest level since January 2023. All three major HMI indices are falling including current sales conditions (46), sales expectations for the next six months (44), and buyer traffic (26). All four regions: Northeast(50), Midwest(30), South(49), and West(41) were lower.

FEDERAL RESERVE UPDATE

Federal Reserve Chair Powell offered a speech today at the Economic Club of New York. Chair Powell made the following observations:

Headline PCE inflation is estimated at 3.5% and core-PCE inflation is estimated at 3.7% through September.

Inflation is still too high and the Fed is committed to achieving its 2% inflation target.

The labor market remains strong, but is closer to being balanced.

The Fed expects below-trend growth will be needed to bring inflation down to its 2% target.

Monetary policy is restrictive and will remain “sufficiently restrictive to bring inflation sustainably down to 2 percent over time”.

Following Chair Powell’s remarks, the FedWatch probability of a rate hike at the December FOMC meeting decreased to just 25%.

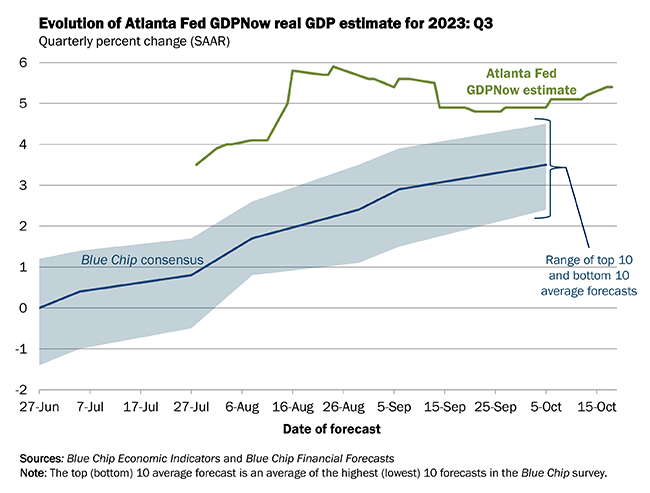

On October 26th the Bureau of Economic Analysis (BEA) will release the advance estimate of third-quarter GDP. The most recent Atlanta Fed GDPNow forecast is for third-quarter GDP growth of 5.4%. The BEA will release the September PCE Inflation report on October 27th. The FOMC meeting is on October 31st and November 1st. We do not expect any change to the federal funds rate at the meeting.