May Jobs Report and June FOMC Meeting

May 2023

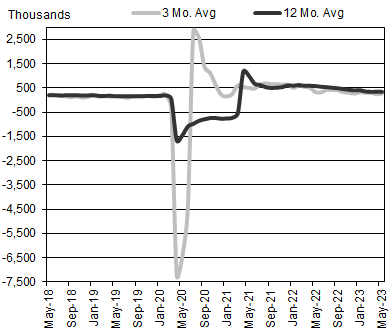

Nonfarm payrolls increased by 339,000 in May and the unemployment rate increased 0.3% to 3.7%. Since the monthly jobs figure can be volatile, we prefer to look at the 3-month moving average (3MMA) of job gains. Over the past year, the 3MMA has decelerated from 524,000 in April 2022 to 283,333 in May 2023. We expect the pace of job growth to continue to slow in the second half of 2023. Monthly payroll gains of over 200,000 indicate a healthy labor market and exceed the pace that Fed Chair Powell is hoping to achieve as he attempts to bring the labor market into balance. The March and April jobs figures were revised higher +52,000 and +41,000 respectively for a total adjustment of +93,000 versus the previously reported figures. Over the most recent 12-month period, the monthly average job gains were 338,583, or 4.1 million total jobs.

The 3.7% unemployment rate in May lifted the unemployment rate toward the upper end of its recent range. The unemployment rate has been remarkably stable over the past 15 months oscillating between 3.4% and 3.8%, near the lowest levels on record. An increase in the unemployment rate above the 4.0% level would be a real-time indication that a mild recession is underway.

The Federal Open Market Committee (FOMC) is scheduled to hold another monetary policy meeting next week on Tuesday June 13th and Wednesday June 14th. The timing of the Fed meeting is complicated by next week’s release of the consumer price index (CPI) inflation report on Tuesday June 13th. As of this writing, Fed Chair Powell appears to be planning to “skip” raising rates at next week’s FOMC meeting. The term ‘skip’ is being used instead of ‘pause’ to indicate that additional rate hikes may be necessary at future meetings to combat too-high inflation and too-strong job growth. Today’s CME FedWatch probabilities show a two-thirds chance of no rate hike and a one-third chance of a 25 basis point rate hike next week. If next week’s inflation figure is close to the expected range, the Fed is likely to hold rates unchanged. However, a rate hike cannot be ruled out if next Tuesday’s inflation data is much higher than expected. The Fed decision is data-dependent, but a ‘skip’ is likely.

Next week’s FOMC meeting provides FOMC members an opportunity to share their latest economic projections. We will be looking at the dotplot which illustrates each FOMC member’s forecast of the fed funds target range at year-end 2023, 2024, and 2025. Most important to us is how many ‘dots’ will be below the current target range later this year and at the end of 2024. The chart below shows the most recent March projections. As you can see, just one FOMC member forecasted a fed funds rate below 5% in December 2023 at the March meeting. We expect a few dots will move slightly higher next week.