Model Portfolio Update

Thursday September 7, 2023

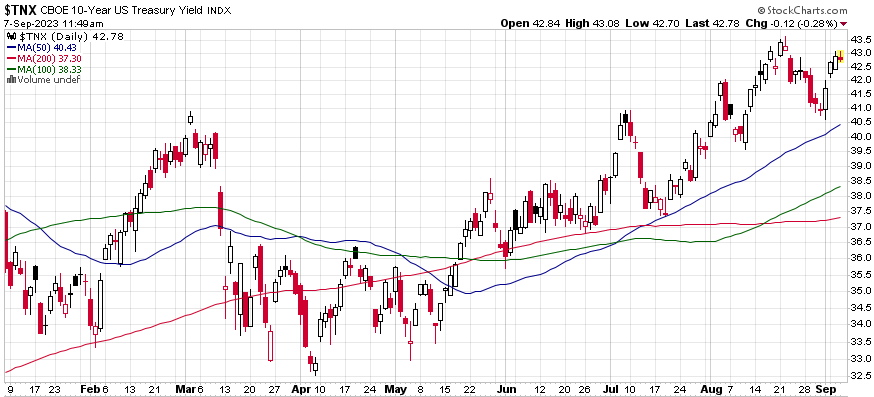

Earlier this year we made the decision to sell our position in longer-term U.S. Treasuries due to our concern that economic growth was likely to accelerate and a disinflationary period was setting in. At the time longer-term rates were near their lowest levels of the year. Since our decision in May 2023, we have watched longer-term yields rise steadily. As shown in the chart below, the 10-year UST yield has risen from 3.4% to 4.3%.

We are seeing signs that the move higher in longer-term yields may be nearing an end. Therefore, we are making the following changes to our Brinker Fixed Income Advisor Aggressive Model Portfolio. BrinkerAdvisor.com subscribers can see our Model Portfolios anytime on our Subscriber’s Only page. Our Model Portfolios are updated the first week of every month.

We are making the following changes…