Model Portfolios | December Update

S&P 500 4567.80 :: 10-Year UST Yield 4.35% :: November 30, 2023

“Understanding both the power of compound interest and the difficulty of getting it is the heart and soul of understanding a lot of things.”

-Charlie Munger

COMMENTARY

We thank you for supporting our work and wish you a happy holiday season and a prosperous New Year. Looking ahead to 2024, we forecast real GDP growth within a range of 1% to 2%, a deceleration in the pace of inflation toward the Fed's 2% target level, and a weakening labor market in response to the Fed's restrictive monetary policy.

Third quarter 2023 real GDP growth was revised to 5.2% following the second quarter’s 2.1% increase. Consumer spending, private inventory investment, exports, and government spending contributed to the GDP increase. We expect the pace of GDP growth to slow in the fourth quarter. The latest GDPNow forecast is for 1.8% real GDP during the fourth quarter.

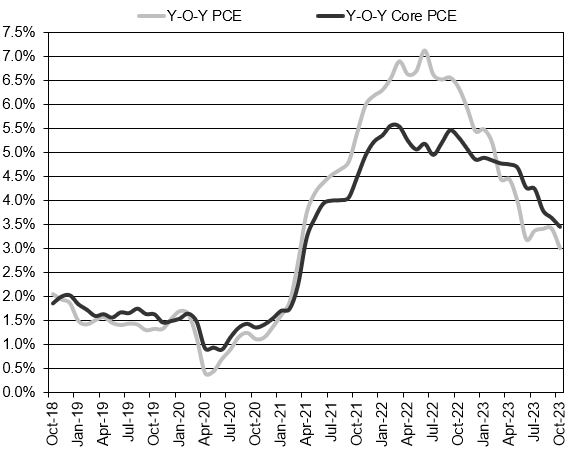

The disinflationary trend that began in mid-2022 remains in place. The Fed’s preferred inflation measure is the personal consumption expenditures (PCE) price index. The headline PCE inflation rate fell to 3.0% year-over-year in October and is down from its peak reading of 7.1% in June 2022. The core PCE inflation rate, which excludes the volatile food and energy components, fell to 3.5% year-over-year in October and core PCE inflation is down from its peak level of 5.6% in February 2022. The Fed’s inflation target is 2.0%, so more work remains, but the disinflationary trend continues and monetary policy remains restrictive. The most recent three-month core PCE rate is 2.37% annualized, not too far above the Fed’s 2.0% inflation target.

The S&P 500 saw substantial gains in November rising 8.9% during the month. After closing at a year-to-date high of 4,588.96 on July 31st, the S&P 500 experienced a -10.3% price correction when it reached its closing low of 4,117.37 on October 27th. From that low, the S&P 500 rallied 10.9% to its November 30th closing level of 4567.80 and is up 19.0% this calendar year through November.

The NAHB/Wells Fargo Housing Market Index (HMI) fell for the fourth consecutive month to 34 in November, from 40 the previous month. This is the lowest reading since December 2022. Readings above 50 are indicative of favorable single-family home builder sentiment. The current sales conditions index declined six points to 40, the measure of sales expectations over the next six months fell five points to 39, and the prospective buyer traffic index dropped five points to 21. The NAHB Chair observed that "Given the lack of existing home inventory, somewhat lower mortgage rates will price-in housing demand and likely set the stage for improved builder views of market conditions in December." NAHB forecasts a 5% increase for single-family housing starts in 2024.

FEDERAL OPEN MARKET COMMITTEE

The Federal Open Market Committee (FOMC) is scheduled to meet on December 12th and 13th. The FOMC meeting will include an updated Summary of Economic Projections (SEP) and will be followed by a media conference hosted by Fed Chair Powell. We do not anticipate any change in the federal funds rate at the December meeting. We also expect the Fed’s quantitative tightening program to continue into 2024. So far, the Fed’s balance sheet has declined from a peak of $9.0 trillion down to $7.8 trillion. The Fed has been shrinking its balance sheet at a pace of approximately $95 billion per month.

Below is the most recent FOMC SEP forecast published following the September Fed meeting. We will be watching to see whether the central tendency of the federal funds target rate for 2024 changes in the December forecast.

The Fed has published the following tentative FOMC meeting schedule for 2024:

January 30-31

March 19-20*

Apr/May 30-1

June 11-12*

July 30-31

September 17-18*

November 6-7

December 17-18*

* Summary of Economic Projections Updated

MONEY SUPPLY

Below is the monthly update of the Marketimer Model Portfolios and the Brinker Fixed Income Advisor Model Portfolios through November 30, 2023.