Model Portfolios | February Update

S&P 500 4845.65 :: 10-Year UST Yield 3.95% :: January 31, 2024

"The big money is not in the individual fluctuations, but in the main movements, in sizing up the entire market and its trend."

COMMENTARY

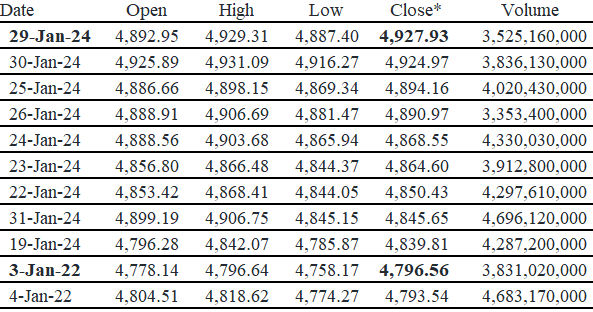

The S&P 500 closed in record-high territory multiple times in January as it finally exceeded its previous all-time closing high of 4,796.56 from more than two years ago. Since establishing a short-term correction bottom at 4,117.37 on October 27, 2023, the S&P 500 has rallied 17.7% to its January 31st closing level of 4845.65. Given the outsized equity gains over the past three months, we think a period of consolidation would be healthy. Below is a table sorted by the S&P 500 closing price.

Fourth quarter 2023 real GDP growth was 3.3% following the third quarter’s 4.9% increase. We expect the pace of GDP growth to slow in the first quarter. The preliminary Atlanta Fed GDPNow forecast is for 3.0% real GDP during the first quarter. The New York Fed GDP Nowcast stands at 2.8% for the first quarter.

The NAHB/Wells Fargo Housing Market Index (HMI) rose seven points to 44 in January thanks to lower mortgage rates. Readings above 50 are indicative of favorable single-family home builder sentiment. The current sales conditions index rose seven points to 48, the measure of sales expectations over the next six months increased twelve points to 57, and the prospective buyer traffic index rose five points to 29. The NAHB Chief Economist observed “Mortgage rates have decreased by more than 110 basis points since late October per Freddie Mac, lifting the future sales expectation component in the HMI into positive territory for the first time since August”.

FEDERAL OPEN MARKET COMMITTEE

The Federal Open Market Committee (FOMC) held a two-day monetary policy meeting on January 30th and 31st. FOMC members voted unanimously to keep the federal funds rate unchanged at the current 5.25% to 5.5% target range and to continue the policy of reducing the Fed’s balance sheet at a pace of roughly $95 billion per month. In the post-meeting statement, FOMC members noted that economic indicators point to an economy expanding at a solid pace, a job market that is moderating but remains strong, and inflation that is decelerating but remains elevated.

In an effort to push back against market pricing of a fed funds rate cut at the next (March) FOMC meeting, officials added this sentence to the policy statement: The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.

It was also notable that Fed Chair Powell opened his post-meeting press conference with an observation that “inflation is still too high, ongoing progress in bringing it down is not assured, and the path forward is uncertain.” This is not the opening statement Chair Powell would choose to deliver if he were leaning toward a March rate cut. In the Q&A session with reporters, Chair Powell also said that a March rate cut is not his base case.

Here is the full post-meeting press conference:

Despite the progress in lowering the pace of inflation to the Fed’s 2% target level, the stronger-than-expected GDP growth and healthy labor market may be enough to keep the Fed on hold. Based on today’s policy remarks, it appears that it would take weakness in the labor market to get the Fed to cut rates in March. Immediately following Chair Powell’s press conference, market probabilities shifted expectations for the first rate cut to May 1st. In our view, it isn’t terribly important whether the initial rate cut is in March or May.

MONEY SUPPLY

Below is the monthly update of the Marketimer Model Portfolios and the Brinker Fixed Income Advisor Model Portfolios through January 31, 2024.