Model Portfolios | February Update

S&P 500 6040.53 :: 10-Year UST Yield 4.54% :: February 1, 2025

“The stock market is that creation of man which humbles him the most.”

-Anonymous

COMMENTARY

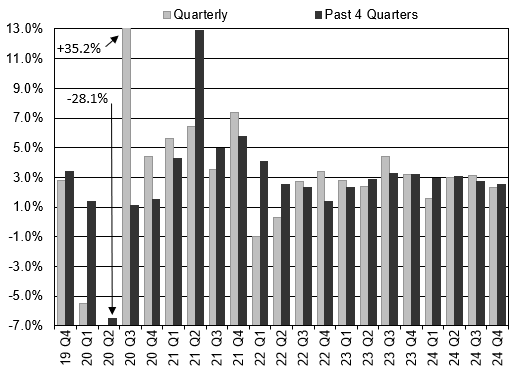

Real gross domestic product (GDP) grew at a 2.3% annual rate in the fourth quarter of 2024, following a 3.1% pace of growth in the third quarter, according to the latest Bureau of Economic Analysis report. For calendar year 2024, real GDP increased at an average rate of 2.5%, slightly above our 2% trend growth estimate.

Personal consumption expenditures (consumer spending) are the most important component within the GDP report, representing nearly 70% of GDP. During the fourth quarter, PCEs contributed 2.8% to the overall 2.3% GDP figure, as consumer spending had another strong quarter. Gross private investment subtracted -1.0%. Net exports were flat, and government consumption expenditures added 0.4%. View a more detailed GDP contribution breakdown in Table 2 of the report. The 2.3% fourth quarter GDP figure was in line with the GDPNow estimate of 2.3% from the Atlanta Fed.

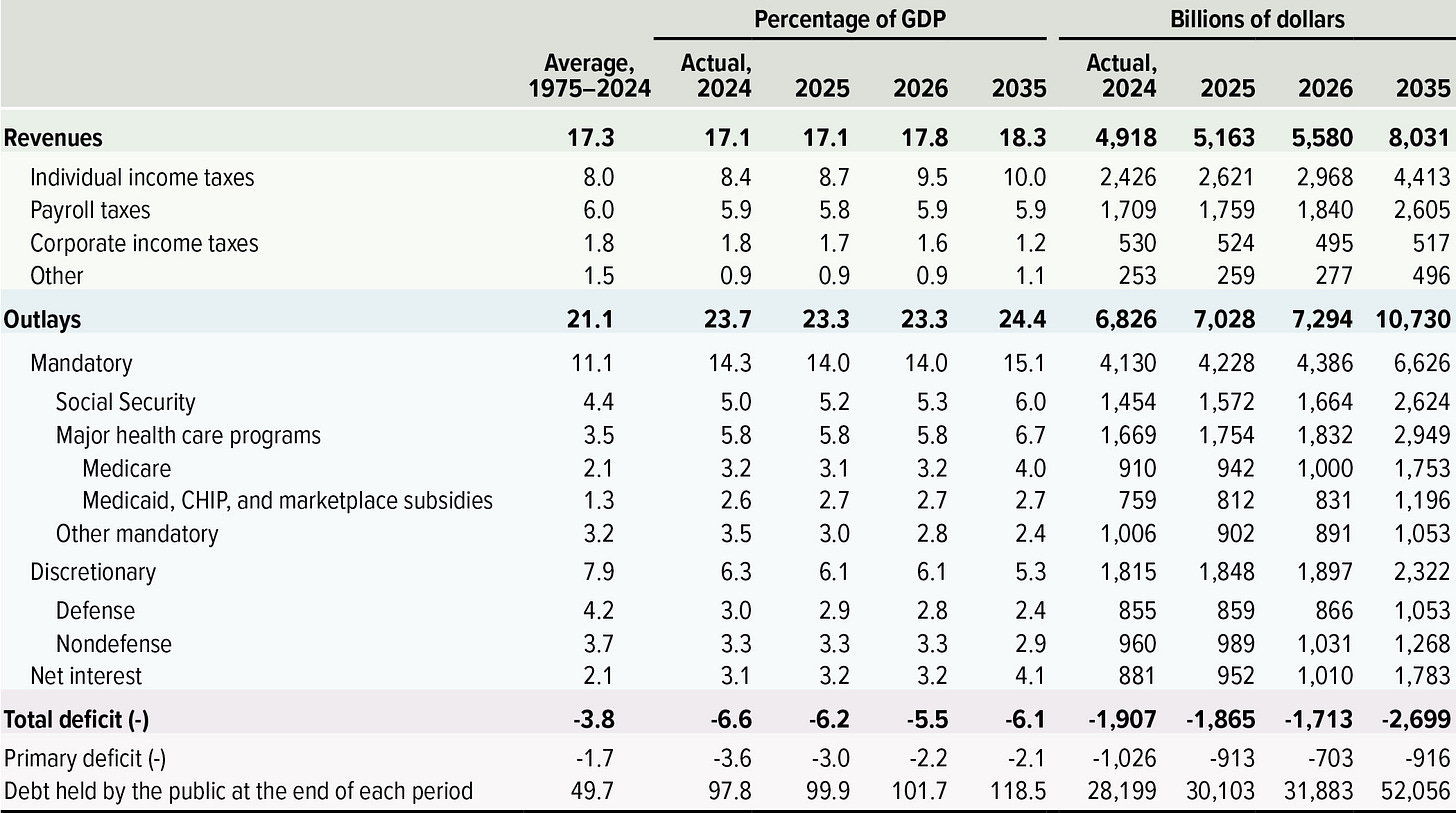

The U.S. Treasury has, once again, reached the debt ceiling. The Fiscal Responsibility Act of 2023 temporarily suspended the debt limit through January 1st, 2025. The new debt limit is $36.1 trillion. Negotiations are underway in Congress to increase, suspend, or abolish the debt ceiling. In the meantime, Treasury will employ extraordinary measures to fund authorized government spending. The Congressional Budget Office (CBO) currently projects the 2025 fiscal year ending September 30th, 2025, to incur a $1.865 trillion budget deficit. This estimate includes expenditures of $7.0 trillion (23.3% of GDP) and receipts of $5.2 trillion (17.1% of GDP). The 2025 budget deficit is forecast to be slightly lower than fiscal year 2024. As shown in the budget outlook table below, CBO forecasts the Net interest expense, which is the annual cost to service the national debt, will rise to $952 billion in the fiscal year 2025 and over $1 trillion in the fiscal year 2026, or roughly 14% of total expenditures.

Source: CBO

INFLATION UPDATE

The Fed’s preferred inflation measure is the personal consumption expenditures (PCE) price index. In December, the headline PCE inflation rate was 2.6% year-over-year. The core PCE inflation rate, which excludes the volatile food and energy components, was 2.8% year-over-year in December. The 3-month annualized core PCE inflation rate has decelerated from 2.8% to 2.2% over the past few months. If this disinflationary trend continues over the coming months, additional fed funds rate cuts may come later this year.

Headline PCE:

+0.3% seasonally adjusted in December, following 0.1% in November

+2.6% year-over-year

+2.5% latest 3 months annualized

+2.2% latest 6 months annualized

Core PCE: (excludes food and energy)

+0.2% seasonally adjusted in December, following 0.1% in November

+2.8% year-over-year

+2.2% latest 3 months annualized

+2.3% latest 6 months annualized

HOUSING MARKET UPDATE

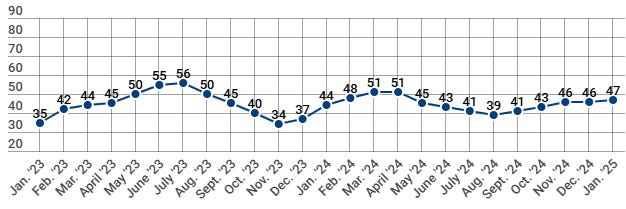

The NAHB/Wells Fargo Housing Market Index (HMI) measures conditions in the single-family housing market. The index rose one point in January from 46 to 47. HMI Index readings above 50 are indicative of favorable single-family home builder sentiment. The current sales conditions index increased three points to 51, the measure of sales expectations over the next six months fell six points to 60, and the prospective buyer traffic index rose two points to 33. The NAHB Chief Economist noted “NAHB is forecasting a slight gain for single-family housing starts in 2025, as the market faces offsetting upside and downside risks from an improving regulatory outlook and ongoing elevated interest rates”. Regionally, the Northeast was the strongest with a rise of five points to 60. The Midwest rose one point to 47, and the South rose one point to 46. The West remained the weakest falling one point to 40.

FEDERAL RESERVE UPDATE

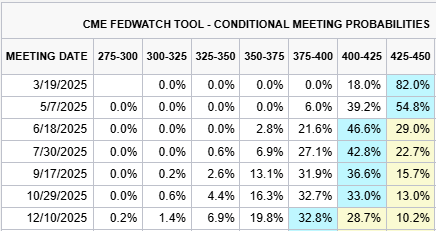

The Federal Open Market Committee (FOMC) voted unanimously to keep the federal funds rate unchanged at the January 28th and 29th meeting. In the post-meeting statement, FOMC members noted the “unemployment rate has stabilized at a low level in recent months, and labor market conditions remain solid. Inflation remains somewhat elevated.”

The next FOMC meeting is scheduled for March 18th and 19th. The March meeting will include an updated Summary of Economic Projections (SEP). Fed Governor Waller shared an interesting speech in January that sums up the current FOMC thinking. Most FOMC members anticipate a few rate cuts this year, but that forecast is based on an expectation that the disinflationary trend will reassert itself over the coming months.

Chair Powell expressed a similar view in his post-meeting press conference remarks.

As the economy evolves, we will adjust our policy stance in a manner that best promotes our maximum employment and price stability goals. If the economy remains strong and inflation does not continue to move sustainably toward 2 percent, we can maintain policy restraint for longer. If the labor market were to weaken unexpectedly or inflation were to fall more quickly than anticipated, we can ease policy accordingly. Policy is well positioned to deal with the risks and uncertainties that we face in pursuing both sides of our dual mandate.

-Fed Chair Powell

Here are links to the Jan 29th Press Conference Video and Transcript

As of this writing, there is a greater than 80% probability that rates remain unchanged at the March FOMC meeting.

MONEY SUPPLY

MODEL PORTFOLIOS UPDATE

Below is the monthly update of the Marketimer and Brinker Fixed Income Advisor Model Portfolios through January 31, 2025.