Model Portfolios | January Update

S&P 500 6845.50 | 10-Year UST Yield 4.17% | January 1, 2026

“What may work for the few cannot work for the many.”

COMMENTARY

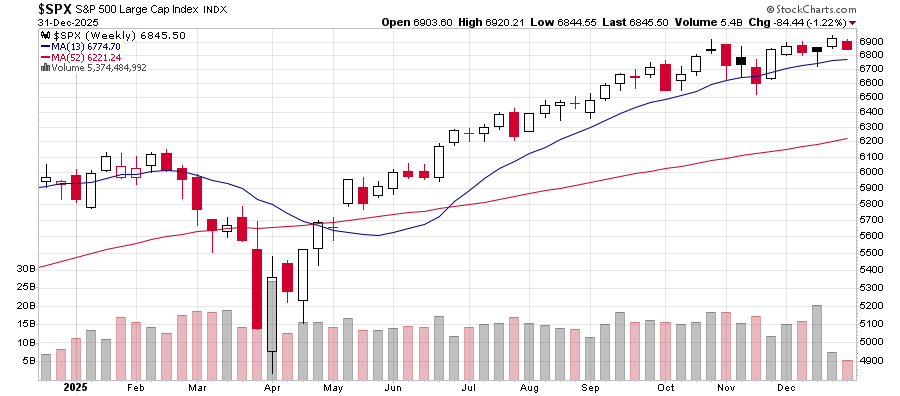

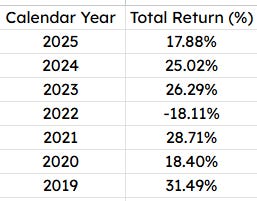

Happy New Year! 2025 was another excellent year for stock and bond investors. The S&P 500 Index produced a total return of 17.9%, and the S&P U.S. Aggregate Bond Index increased 7.1%. The Vanguard Federal Money Market Fund (VMFXX) returned 4.2%. The Vanguard Total Stock Market Index Fund (VTSAX) returned 17.1%.

The S&P 500 Index has posted strong total returns in six of the past seven years:

The S&P 500 set numerous all-time closing highs throughout the year, ending the year just below its record-high closing level of 6,932 achieved on December 24th. The table below shows the ten highest S&P 500 Index closing levels:

Looking ahead, our 2026 forecast is for 2% real GDP growth, a deceleration in inflation toward the Fed’s 2% target, and a weakening labor market.

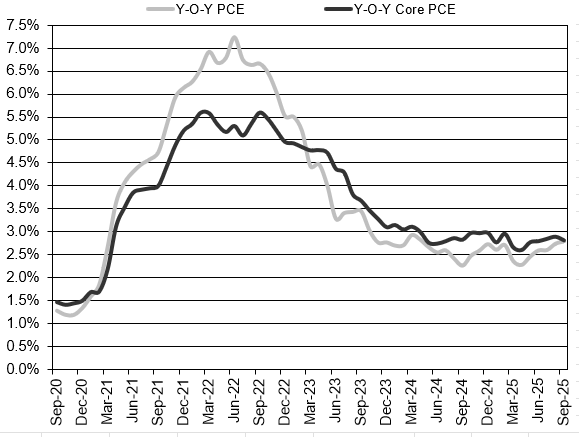

INFLATION UPDATE

The Fed’s preferred inflation measure is the personal consumption expenditures (PCE) price index. We finally received the shutdown-delayed inflation figures for September 2025, which showed the headline PCE inflation rate was 2.8% year-over-year. The core PCE inflation rate, which excludes the volatile food and energy components, was also 2.8% year-over-year.

Headline PCE:

+0.3% seasonally adjusted in September, following 0.3% in August

+2.8% year-over-year

+2.8% latest 3 months annualized

+2.7% latest 6 months annualized

Core PCE: (excludes food and energy)

+0.2% seasonally adjusted in September, following 0.2% in August

+2.8% year-over-year

+2.7% latest 3 months annualized

+2.7% latest 6 months annualized

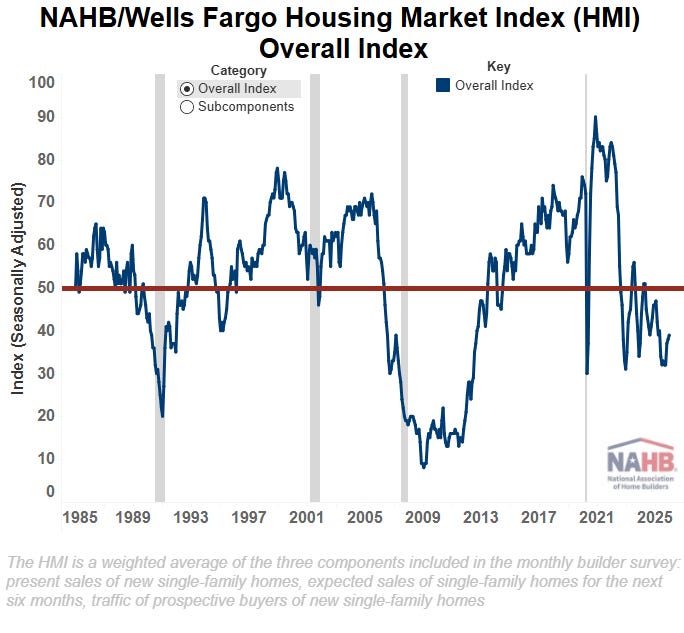

HOUSING MARKET UPDATE

The NAHB/Wells Fargo Housing Market Index (HMI) measures conditions in the single-family housing market. The index rose 1 point in December to 39, though it remains below the 50 threshold that signals favorable sentiment among builders. The current sales conditions index increased by 1 point to 42; the measure of sales expectations over the next 6 months rose by 1 point to 52; and the prospective buyer traffic index held steady at 26. The new single-family home market continues to show signs of cooling, with 40% of builders reporting price cuts in December. The use of sales incentives reached 67%, the highest percentage in the post-COVID-19 era. The NAHB Chairman noted that “builders are contending with rising material and labor prices, as tariffs are having serious repercussions on construction costs.” Regionally, the Northeast fell 1 point to 47, the Midwest rose 2 points to 43, the South increased 2 points to 36, and the West gained 4 points to 34.

FEDERAL RESERVE UPDATE

The Federal Open Market Committee (FOMC) voted to lower the federal funds rate 25 basis points at the December FOMC meeting to a target range of 3.5% to 3.75%. FOMC members noted that although inflation remains somewhat elevated, job gains have slowed and the unemployment rate edged higher. The FOMC also determined that reserve balances have declined to ‘ample’ levels and initiated purchases of shorter-term Treasury securities as needed to maintain an ample supply of reserves. Three FOMC members voted against the December policy action. Stephen Miran preferred a 50 basis point rate cut. Austan Goolsbee and Jeffrey Schmid preferred keeping the federal funds rate unchanged.

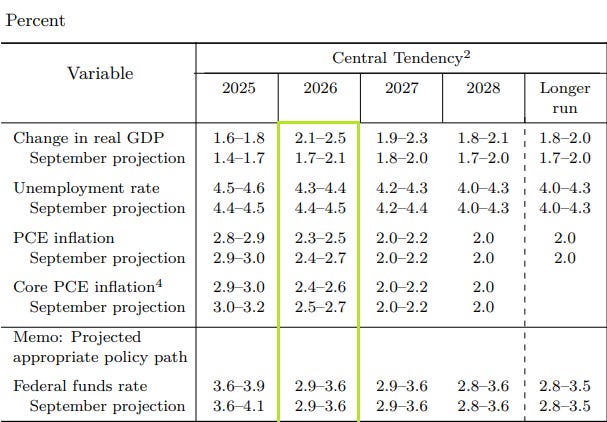

The December meeting provided FOMC members with an opportunity to share their latest economic forecasts. Over the next 12 months (through December 2026), the central tendency of those forecasts is real GDP growth of 2.1% to 2.5%, an unemployment rate of 4.3% to 4.4%, headline PCE inflation of 2.3% to 2.5%, and core PCE inflation of 2.4% to 2.6%. The federal funds rate forecast ranges from 2.9% to 3.6%.

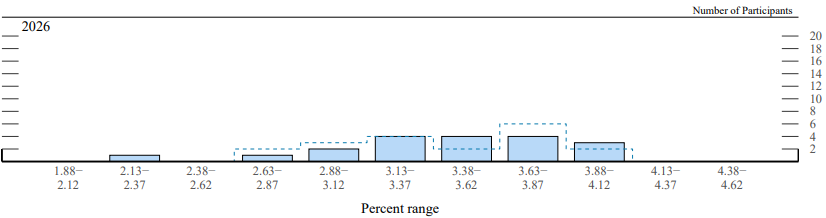

Below is a chart showing the distribution of FOMC members’ fed funds rate forecasts for December 2026, highlighting the divergent views on monetary policy.

Following the December meeting, Fed Chair Powell hosted a press conference. You can watch it below or read the PDF transcript.

The next FOMC meeting is scheduled for January 27th and 28th. As of this writing, a rate cut is not expected at the January meeting. However, if the jobs figures continue to disappoint, another rate cut in January will become increasingly likely over the coming weeks.

Here are the scheduled 2026 FOMC meetings:

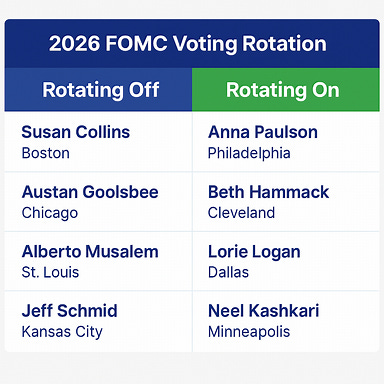

And here are the FOMC voting member rotations for 2026:

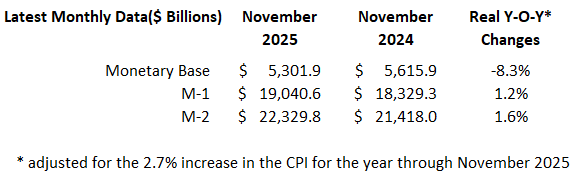

MONEY SUPPLY

MODEL PORTFOLIOS UPDATE

Below is the monthly update of the Marketimer and Brinker Fixed Income Advisor Model Portfolios through December 31, 2025.