Model Portfolios | March Update

S&P 500 5096.27 10-Year UST Yield 4.25% :: February 29, 2024

“Investing is not nearly as difficult as it looks. Successful investing involves doing a few things right and avoiding serious mistakes.”

COMMENTARY

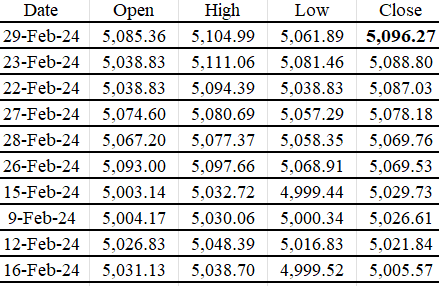

The S&P 500 closed in record-high territory on multiple occasions throughout February and finished the month at another all-time record high. Since bottoming in late October 2023 at a closing low of 4,117, the S&P 500 has risen 23.8% over the past four months to 5,096. The S&P 500 is trading at 20.8 times our calendar year 2024 earnings estimate.

Below is a list of the Top 10 S&P 500 highest closing levels, all of which occurred in February 2024:

Money Market Assets climbed to $6.06 trillion in February. Here is a link to our recent post highlighting the most attractive money market and CD rates. We plan to publish a mid-month update with the best rates available nationwide every month.

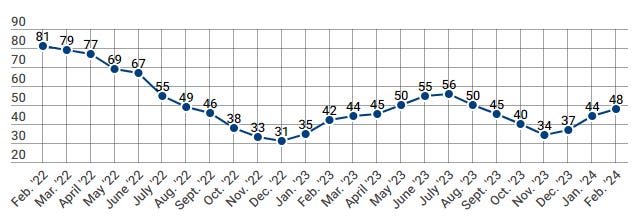

The NAHB/Wells Fargo Housing Market Index (HMI) increased four points to 48 in February, the highest reading since August 2023. Readings above 50 are indicative of favorable single-family home builder sentiment. The current sales conditions index rose four points to 52, the measure of sales expectations over the next six months increased three points to 60, and the prospective buyer traffic index rose four points to 33. The NAHB Chief Economist noted that “the recovery will be bumpy as buyers remain sensitive to interest rate and construction cost changes, the 10-year Treasury rate is up more than 40 basis points since the beginning of the year”.

INFLATION UPDATE

The personal consumption expenditure (PCE) inflation report showed the PCE price index increased 0.3% in January. The core PCE, which excludes the food and energy components, rose 0.4% during the month.

The pace of headline PCE inflation peaked at 7.1% year-over-year in June 2022 and has decelerated to 2.4%. The core PCE rate peaked at 5.6% in February 2022 and has decelerated to 2.8%. The three-month headline PCE inflation rate is just below the Fed’s stated 2.0% inflation target at 1.8% but the three-month core-PCE rate is still too high at 2.6%. Several Fed officials have recently said they want to see further evidence that inflation is returning to the 2.0% target level before lowering the fed funds rate.

Headline PCE:

+0.3% seasonally adjusted in January, following 0.1% in December

+2.4% year-over-year

+1.8% latest 3 months annualized

+2.5% latest 6 months annualized

Core PCE: (excludes food and energy)

+0.4% seasonally adjusted in January, following +0.1% in December

+2.8% year-over-year

+2.6% latest 3 months annualized

+2.5% latest 6 months annualized

FEDERAL RESERVE UPDATE

The next FOMC Meeting is scheduled for March 19-20. The meeting will include an updated Summary of Economic Projections (SEP) from FOMC members. Here is a link to their most recent December 2023 projections. We will be looking to see if the central tendency of the year-end 2024 federal funds rate projection is unchanged or slightly higher than the 4.4% to 4.9% range. We do not anticipate any monetary policy change at the March meeting.

MONEY SUPPLY

Below is the monthly update of the Marketimer Model Portfolios and the Brinker Fixed Income Advisor Model Portfolios through February 29, 2024.