Model Portfolios | November Update

S&P 500 6840.20 | 10-Year UST Yield 4.08% | November 1, 2025

“Cash combined with courage in a time of crisis is priceless.”

–Warren Buffett

COMMENTARY

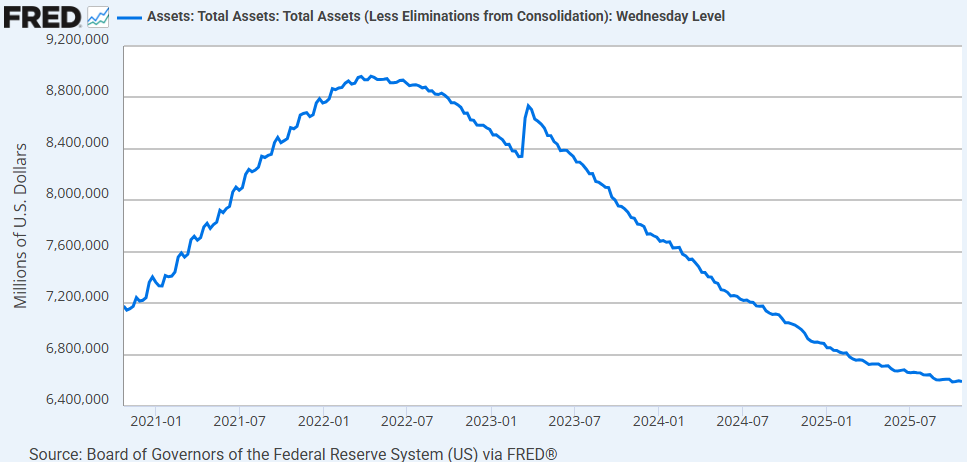

The Federal Open Market Committee (FOMC) voted to lower the federal funds rate 25 basis points to a target range of 3.75% to 4.0% at the October meeting. FOMC members also decided to conclude their quantitative tightening (QT) program, effective December 1st. The QT program has enabled the Fed’s balance sheet to shrink by more than $2.2 trillion from a peak of $9 trillion in April 2022 to its current $6.6 trillion level.

In the post-meeting statement, FOMC members noted moderate economic growth, an elevated inflation rate, and a slowing labor market. FOMC members are divided on whether additional rate cuts are needed, and the October meeting highlighted those divisions. There were two votes against the policy decision, with one member (Stephen Miran) favoring a larger 50 basis point rate cut and another (Jeffrey Schmid) wanting to keep the federal funds rate unchanged.

Hopefully, there will be more timely economic data on the labor market and inflation available to committee members over the coming weeks. The next FOMC meeting is scheduled for December 9th and 10th. The December meeting will include an updated Summary of Economic Projections, which presents economic forecasts for real GDP growth, inflation, unemployment, and the federal funds rate. As of this writing, investors currently think a 25 basis point rate cut is slightly more likely than no rate cut at the December meeting. However, these expectations are likely to change as more recent inflation and labor market data are published between now and early December.

Subscribers can watch Fed Chair Powell’s press conference online or read the PDF Transcript.

“The outlook for employment and inflation has not changed much since our meeting in September. Conditions in the labor market appear to be gradually cooling, and inflation remains somewhat elevated.” -Fed Chair Powell

The FOMC published the following meeting schedule for 2026: January 27-28, March 17-18*, April 28-29, June 16-17*, July 28-29, September 15-16*, October 27-28, December 8-9*. The asterisk* denotes meetings that include an updated Summary of Economic Projections.

Fed Chair Powell’s four-year term as Chairman of FOMC runs from May 2022 to May 2026. According to recent reports, five candidates are being considered to replace Chair Powell: Kevin Hassett, Kevin Warsh, Christopher Waller, Michelle Bowman, and Rick Rieder. An announcement is coming soon about who will be the next Fed Chair. We do not expect Chair Powell to remain on the Board of Governors after his term as Chair expires, though that option is available.

HOUSING MARKET UPDATE

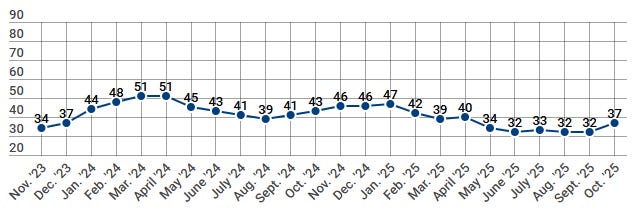

The NAHB/Wells Fargo Housing Market Index (HMI) measures conditions in the single-family housing market. The index rose five points in October to 37, the highest reading since April, though still below the 50 threshold that signals favorable sentiment among builders. The current sales conditions index increased four points to 38, the measure of sales expectations over the next six months jumped nine points to 54, and the prospective buyer traffic index gained four points to 25. According to NAHB economists, “most home buyers are still on the sidelines, waiting for mortgage rates to move lower.” In October, 38% of builders reported cutting home prices, with the average reduction rising to 6%, while 65% continued to use sales incentives to attract buyers. Regionally, the Northeast rose two points to 46, the Midwest was steady at 42, the South increased two points to 31, and the West gained two points to 28.

INFLATION UPDATE

Due to the government shutdown, the Bureau of Economic Analysis (BEA) is not publishing the monthly personal consumption expenditure (PCE) price index report. We expect the government shutdown will end soon, and the inflation and labor market reports will resume.

In the meantime, the Bureau of Labor Statistics convened to compile the consumer price index (CPI) inflation report, as the information was needed to compute Social Security’s annual Cost-of-Living adjustment (COLA). “The 2.8 percent cost-of-living adjustment (COLA) will begin with benefits payable to nearly 71 million Social Security beneficiaries in January 2026” per SSA.gov.

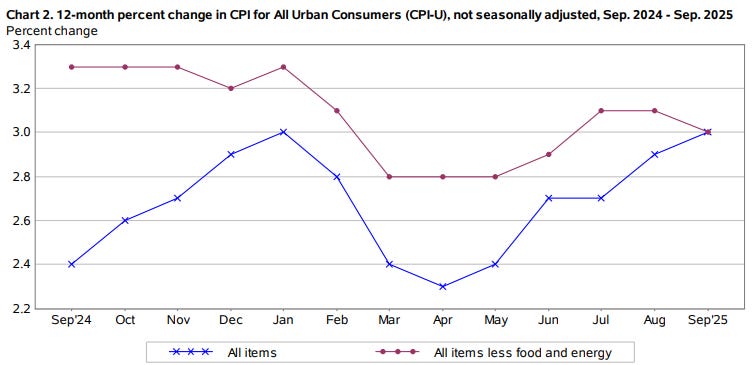

The headline CPI rose 0.3% in September, following a 0.4% increase in August. Over the most recent twelve month period, headline CPI rose 3.0%. The core CPI, which excludes the volatile food and energy components, rose 0.2% in September. During the past twelve months, core CPI increased 3.0%. As shown in the chart below, the inflation rate remains above the Fed’s 2% target level.

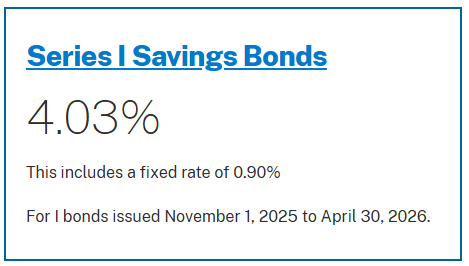

Treasury announced the updated Series I Savings Bond rate last week. The updated 4.03% rate applies to I Bonds purchased from Nov 1, 2025 to April 30, 2026. The rate includes a 0.90% fixed rate and a 1.56% semiannual inflation rate.

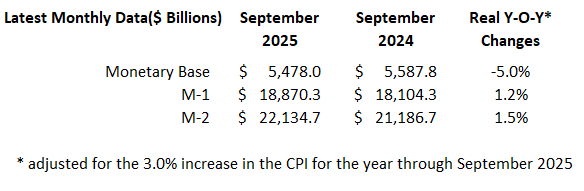

MONEY SUPPLY

MODEL PORTFOLIOS UPDATE

Below is the monthly update of the Marketimer and Brinker Fixed Income Advisor Model Portfolios through October 31, 2025.