Model Portfolios | September Update

S&P 500 5648.40 10-Year UST Yield 3.90% :: August 31, 2024

“I'm one of the luckiest people in the world. I found something I enjoy doing. I've been able to do it for over three decades. You have made doing this broadcast a pleasure and have proved you are the best of all radio listeners.” … “To all of our MoneyTalk listeners, thank you for making this program a success over such a long time period. Happy investing to all of you. May the odds be ever in your favor.”

-Bob Brinker’s MoneyTalk, Final Sign-Off September 2018

COMMENTARY

My family and I are moved by the support and kindness we've received from readers and listeners following the death of my father, Bob Brinker (Sr). Your heartfelt messages, memories, and condolences have been a source of comfort. Dad always cherished the connection he had with his listeners and your outpouring of support is a testament to the impact he had on so many lives. Thank you.

The S&P 500 finished August at 5648 just below its all-time closing high of 5667 achieved six weeks ago on July 16th, 2024. For the second time this year, the S&P 500 rallied quickly after a brief market correction. Historically, presidential election years are bullish. So far this year, the Vanguard Total Stock Market ETF (Symbol: VTI) has gained 18.2% year-to-date.

According to ICI, Money Market Fund Assets continue to increase, rising to $6.3 trillion in August. Here is our recent post highlighting the most attractive money market and CD rates available nationwide. We update the list every month.

The NAHB/Wells Fargo Housing Market Index (HMI) fell two points to 39 in August, the lowest reading this year. Readings above 50 are indicative of favorable single-family home builder sentiment. The HMI survey indicates home builders are increasingly lowering prices to attract buyers. The current sales conditions index fell two points to 44, the measure of sales expectations over the next six months increased one point to 49, and the prospective buyer traffic index fell two points to 25. Regionally, the Northeast was the strongest, despite falling four points to 52, and the West was the weakest with an unchanged reading of 37. The Midwest fell four points to 39 and the South dropped two points to 42.

INFLATION UPDATE

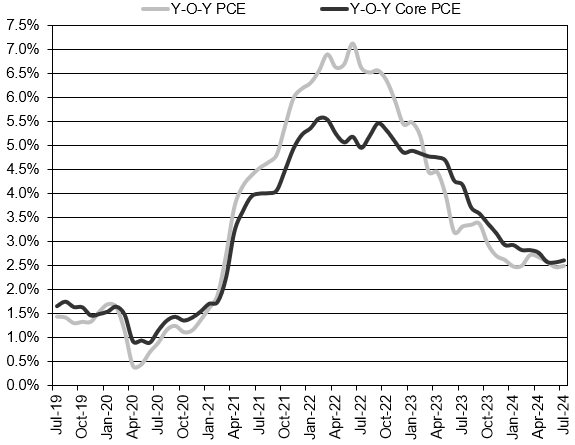

The Fed’s preferred inflation measure is the personal consumption expenditure (PCE) price index. The most recent PCE inflation report showed the index increased 0.2% for the month of July. The core PCE, which excludes the food and energy components, also rose 0.2% during the month.

The pace of headline PCE inflation has been hovering around 2.5% year-over-year and the core PCE rate has been around 2.6% year-over-year recently. The three-month annualized headline PCE inflation rate is just 0.9% and the three-month annualized core-PCE rate is down to 1.7%. The PCE inflation figures are now low enough that FOMC members are likely to vote in favor of a fed funds rate cut at the upcoming September 17th and 18th fed meeting.

Headline PCE:

+0.2% seasonally adjusted in July, following 0.1% in June

+2.5% year-over-year

+0.9% latest 3 months annualized

+2.3% latest 6 months annualized

Core PCE: (excludes food and energy)

+0.2% seasonally adjusted in July, following +0.2% in June

+2.6% year-over-year

+1.7% latest 3 months annualized

+2.6% latest 6 months annualized

FEDERAL RESERVE UPDATE

The next FOMC meeting is scheduled for September 17th and 18th. We expect a 25 basis point rate cut at the September meeting. Fed Chair Powell has indicated he has seen enough sustainable progress on lowering inflation to commence cutting rates and he does not want to see further weakness in the employment data. If the unemployment rate continues to tick higher, a 50 basis point rate cut may be an option. As shown in the CME FedWatch Tool below, most investors anticipate a quarter-point rate cut in September.

MONEY SUPPLY

Below is the monthly update of the Marketimer and Brinker Fixed Income Advisor Model Portfolios through August 31, 2024.