Series I Savings Bonds and CPI Update

Headline CPI +3.7% :: Core CPI 4.1%

SERIES I SAVINGS BONDS :: UPDATE

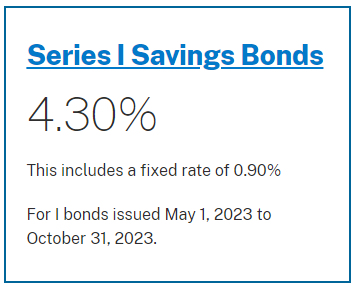

The next Series I bond inflation adjustment will be announced on Wednesday, November 1st 2023. The inflation rate is determined by the realized change in CPI between the six-month period from March 2023 through September 2023. We now know the rate of change during this six-month period is 1.97% semi-annual, or 3.94% annualized. This means the next inflation adjustment will be higher than the current Series I bond semi-annual inflation rate of 1.69% (3.38% annualized).

We also get a new Series I bond fixed rate on November 1st, and we expect the fixed rate will be increased from the current 0.90% rate. The real yield on five-year TIPS is currently 2.45%, quite a bit higher than the Series I savings bond fixed rate. Historically, Treasury has attempted to adjust the I bond fixed rate to be competitive with the five-year TIPS real yield.

We think the next Series I Savings Bond announcement could result in a composite rate above 5.0%. In order for this to happen, the fixed rate will need to be increased to at least 1.1% from the current 0.9% rate. In the meantime, we continue to view five-year TIPS as attractive for purchase with a real yield of 2.45%. The next auction is scheduled for next week on October 19th.

CONSUMER PRICE INDEX (CPI) :: SEPTEMBER 2023

Today’s September CPI inflation report shows that the pace of core inflation continues to decelerate year-over-year. Core CPI peaked a year ago at 6.6% year-over-year in September 2022 and has steadily slowed to 4.1% in September 2023. Since the core CPI is heavily influenced by housing and rent costs, the pace of core CPI is likely to continue to decelerate for some time.

Headline CPI:

+0.4% seasonally adjusted in September, following +0.6% in August

+3.7% year-over-year

Core CPI: (excludes food and energy)

+0.3% seasonally adjusted in September, following +0.3% in August

+4.1% year-over-year

Median and 16% trimmed-mean CPI from Cleveland Fed:

Median +0.5% in September and +5.5% YoY

16% trimmed-mean +0.4% in September and +4.3% YoY