Treasuries, CD Rates, and Muni Auctions

Despite ongoing Fed rate cuts, earning 4% to 5% in cash and CDs remains possible.

U.S. TREASURY AUCTIONS

U.S. Treasury has a full schedule of upcoming auctions. Investors can purchase treasuries at no cost using the TreasuryDirect.gov website or at most major brokerages including Vanguard, Fidelity, and Schwab.

BILLS

BONDS

Treasury Inflation-Protected Securities (TIPS)

The current 5-year TIPS yield is 1.74% (+ CPI).

MONEY MARKET & CD RATES

Below are some of the most attractive money market yields and CD rates available nationwide, sorted by maturities from three months to five years. Click here to see if a bank is FDIC-insured. You can click on the institution name in the list below to go directly to the bank’s website for more information regarding CD purchase minimums, etc. We always recommend individual CD purchases be limited to within the $250,000 FDIC insurance limit.

Money Market Funds:

Vanguard Municipal Money Market Fund 1.99% (tax-exempt)

CDs

3-months:

Total Bank 4.71%

Brilliant Bank 4.60%

Bank5 Connect 4.50%

6-months:

My eBanc 4.80% ($50k minimum)

Total Bank 4.71%

Limelight Bank 4.65%

My Banking Direct 4.60% (5 month)

12-months:

My eBanc 4.65% ($50k minimum)

Limelight Bank 4.50%

NexBank 4.52%

TAB Bank 4.52%

18-months:

My eBanc 4.40% ($50k minimum)

Brilliant Bank 4.35% (15 months)

The Federal Savings Bank 4.30%

TAB Bank 4.29%

2-years:

My eBanc 4.25% ($50k minimum)

TAB Bank 4.24%

The Federal Savings Bank 4.10%

3-years:

TAB Bank 4.03%

My eBanc 3.98% ($50k minimum)

The Federal Savings Bank 3.95%

4-years:

TAB Bank 3.92%

BMO Alto Bank 3.80%

5-years:

Synchrony Bank 4.00%

BMO Alto Bank 3.90%

TAB Bank 3.87%

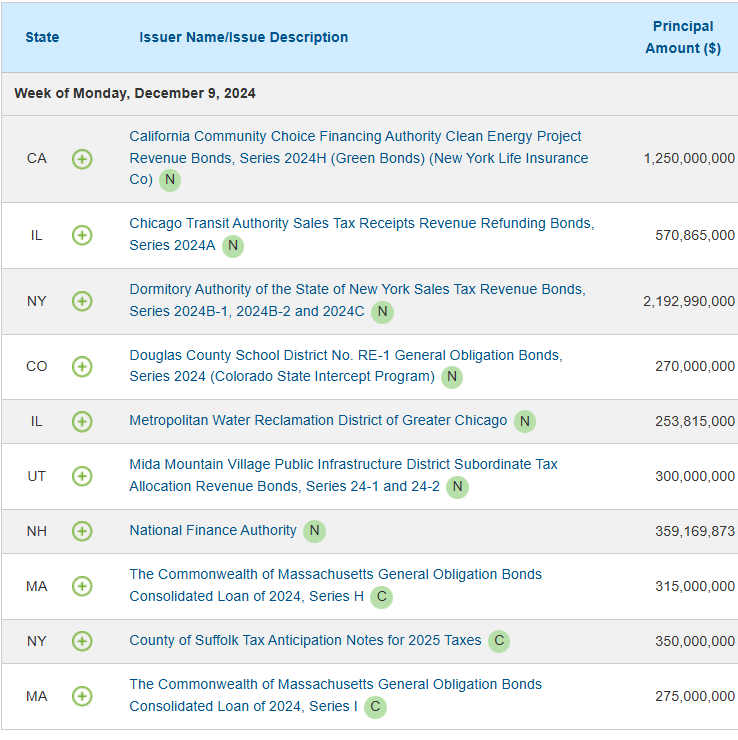

MUNICIPAL BOND AUCTIONS

Below is a list of some of the largest upcoming municipal bond offerings nationwide:

Source: EMMA, BondLink

CONSUMER PRICE INDEX (CPI) | NOVEMBER 2024

The November CPI inflation report showed that core inflation increased 0.3% in November and is up 3.3% year over year. This is not welcome news to FOMC members. A 3.3% core CPI rate is too high. Next week’s planned FOMC rate cut is unlikely to change, but we are looking for an indication from Fed Chair Powell that subsequent rate cuts may be delayed until inflation moves lower.

Headline CPI:

+0.3% seasonally adjusted in November, following +0.2% in October

+2.7% year-over-year

Core CPI: (excludes food and energy)

+0.3% seasonally adjusted in November, following +0.3% in October

+3.3% year-over-year

Median and 16% trimmed-mean CPI from Cleveland Fed:

Median +0.2% in November and +3.9% YoY

16% trimmed-mean +0.3% in November and +3.2% YoY