Treasury Auctions and CD Rates

August 6, 2023 :: A review of the upcoming U.S. Treasury Auctions and some of the best CD rates available nationwide.

The U.S. Treasury has the following Bills, Notes, and Bond auctions scheduled this week. These auctions can be purchased at no cost using the TreasuryDirect.gov website or most major brokerages.

BILLS

NOTES

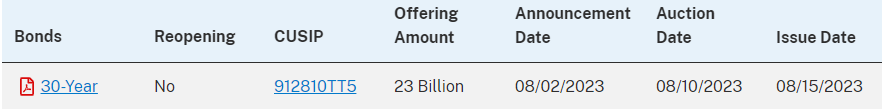

BONDS

Last week Treasury announced its borrowing estimates for the July to September 2023 quarter and the October to December 2023 quarter.

During the July – September 2023 quarter, Treasury expects to borrow $1.007 trillion in privately-held net marketable debt, assuming an end-of-September cash balance of $650 billion.[2] The borrowing estimate is $274 billion higher than announced in May 2023, primarily due to the lower beginning-of-quarter cash balance ($148 billion) and higher end-of-quarter cash balance ($50 billion), as well as projections of lower receipts and higher outlays ($83 billion).[3]

During the October – December 2023 quarter, Treasury expects to borrow $852 billion in privately-held net marketable debt, assuming an end-of-December cash balance of $750 billion.

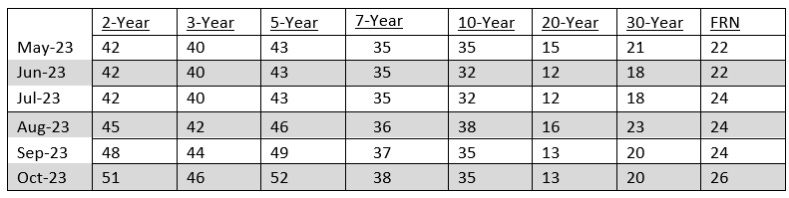

In the Quarterly Refunding Statement, Treasury outlined the auction sizes for various maturities. “The table below presents, in billions of dollars, the actual auction sizes for the May to July 2023 quarter and the anticipated auction sizes for the August to October 2023 quarter:”

CERTIFICATES OF DEPOSIT

Below are some of the highest CD rates (annual percentage yield - APY) available nationwide, sorted by maturities from three months to five years. You can click here to check if a bank is FDIC insured. In addition, you can click on the institution name in the CD list below to go directly to the bank’s website for more information regarding CD purchase minimums, etc. We always recommend individual CD purchases are limited to within the $250,000 FDIC insurance limit.

3-months:

TotalDirectBank 5.20%

WaFd Bank 5.00%

UmbrellaBank 4.75%

6-months:

NexBank 5.50%

TotalDirectBank 5.40%

Popular Direct 5.35%

12-months:

NexBank 5.60%

Northern Bank Direct 5.60% *11-month

Sallie Mae Bank 5.50%

18-months:

Sallie Mae Bank 5.55%

The Federal Savings Bank 5.25%

Popular Direct 5.15%

2-years:

The Federal Savings Bank 5.00%

First Internet Bank 4.85%

Merrick Bank 4.85%

3-years:

PopularDirect 4.75%

First Internet Bank 4.75%

The Federal Savings Bank 4.75%

4-years:

First Internet Bank 4.54%

BMO Alto 4.50%

5-years:

PopularDirect 4.60%

First Internet Bank 4.59%

Thanks, again and again! What’s your insight on the 3-year T note? -Lew