Treasury Auctions and CD Rates

Upcoming U.S. Treasury Auctions and Our Favorite CD Offers.

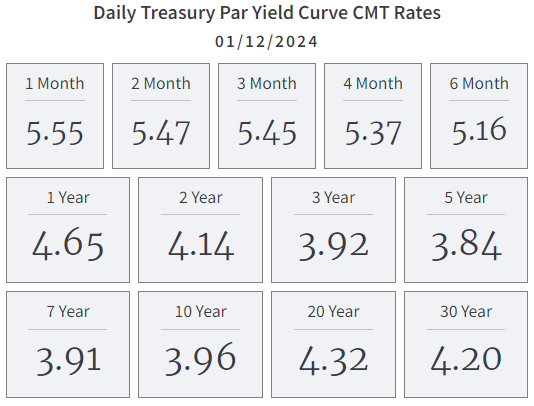

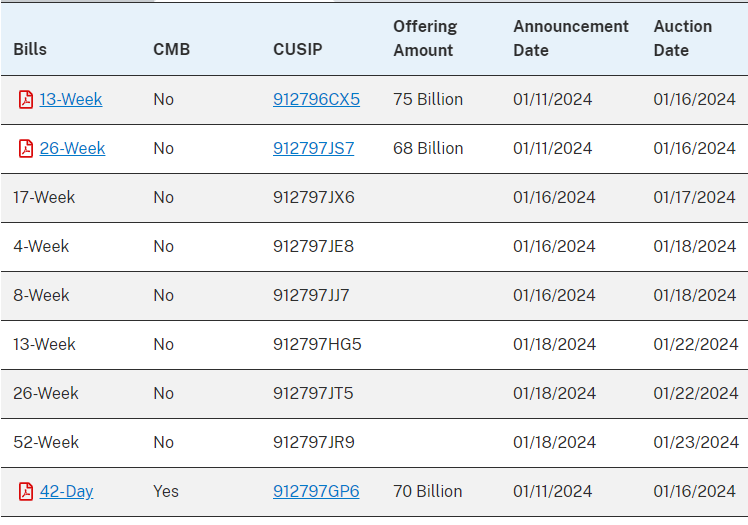

U.S. Treasury has the following schedule of upcoming auctions. These auctions can be purchased at no cost using the TreasuryDirect.gov website or at most major brokerages including Vanguard, Fidelity, and Schwab.

BILLS

NOTES

BONDS

Treasury Inflation-Protected Securities (TIPS)

Floating Rate Notes (FRNs)

CERTIFICATES OF DEPOSIT

Below are some of the highest CD rates (annual percentage yield - APY) available nationwide, sorted by maturities from three months to five years. You can click here to check if a bank is FDIC insured. In addition, you can click on the institution name in the CD list below to go directly to the bank’s website for more information regarding CD purchase minimums, etc. We always recommend individual CD purchases be limited to within the $250,000 FDIC insurance limit.

FDIC publishes its Quarterly Banking Profile report every three months, and the most recent quarter showed banks continued to face challenges as net income declined and unrealized losses grew.

Vanguard Federal Money Market (VMFXX) offers a 7-day Yield of 5.27% and a compound yield of 5.40%. Vanguard Municipal Money Market (VMSXX) offers a 7-day Yield of 2.00% and a compound yield of 2.02%.

3-months:

TotalDirectBank 5.66%

iGoBanking 5.35%

6-months:

TotalDirectBank 5.50%

Bank5 Connect 5.50%

BMO Alto 5.50%

12-months:

NexBank 5.55%

TotalDirectBank 5.50%

BMO Alto 5.50%

18-months:

Sallie Mae Bank 5.30% 15-month and 5.00% 18-month

Marcus by Goldman Sachs 5.25%

Limelight Bank 5.20%

2-years:

MySavingsDirect 5.00%

Sallie Mae Bank 4.90%

Marcus by Goldman Sachs 4.85%

3-years:

MySavingsDirect 5.00%

DollarSavingsDirect 5.00%

4-years:

BMO Alto 4.60%

First Internet Bank 4.54%

5-years:

BMO Alto 4.60%

First Internet Bank 4.59%

Reminder: The next Federal Open Market Committee (FOMC) meeting is scheduled for January 30th and 31st. We do not expect any change in the federal funds rate at the January FOMC meeting.