Treasury Auctions and CD Rates

September 17, 2023 :: Upcoming Treasury Auctions and some of the most attractive CD rates available nationwide.

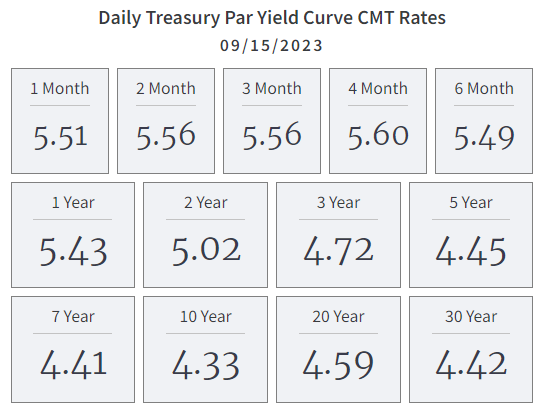

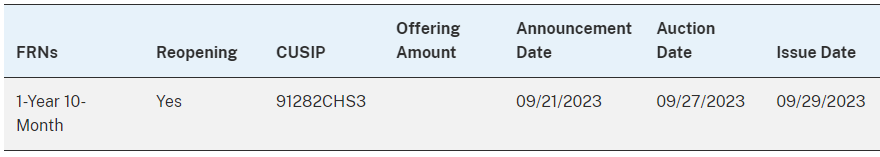

U.S. Treasury has a full schedule of upcoming auctions, including the following Bills, Notes, Bonds, and TIPS. These auctions can be purchased at no cost using the TreasuryDirect.gov website or most major brokerages.

BILLS

NOTES

BONDS

Treasury Inflation-Protected Securities (TIPS)

Floating Rate Notes (FRNs)

FDIC QUARTERLY BANKING PROFILE

The second quarter FDIC Quarterly Banking Profile illustrates the challenging environment in which banks are operating today. Net income decreased during the quarter as unrealized losses on securities increased. Total deposits declined for the fifth consecutive quarter.

Banking Industry Assets Decreased From First Quarter 2023 Total assets of $23.5 trillion declined $254.4 billion (1.1 percent) from first quarter 2023. Securities led the decline (down $175.1 billion, or 3.1 percent), followed by cash and balances due from depository institutions (down $138.1 billion, or 4.9 percent). Year over year, total assets decreased $252.8 billion (1.1 percent). The growth in total loan and lease balances (up $526.8 billion, or 4.5 percent) was offset by declines in total securities (down $712.2 billion, or 11.6 percent) and cash and balances due from depository institutions (down $118.0 billion, or 4.2 percent). Unrealized Losses on Securities Increased Quarter Over Quarter6 Unrealized losses on securities totaled $558.4 billion in the second quarter, up $42.9 billion (8.3 percent) from the prior quarter. Unrealized losses on held-to-maturity securities totaled $309.6 billion in the second quarter, while unrealized losses on available-for-sale securities totaled $248.9 billion.

Source: FDIC QBP

During the second quarter, two banks opened and one bank failed. The number of banks on the FDIC’s “Problem List” remained unchanged at 43 institutions. Total assets at problem banks fell from $58 billion to $46 billion. The Deposit Insurance Fund (DIF) balance increased to $117.0 billion. The recent failure of First Republic Bank put a dent in the DIF earlier this year. “The FDIC recognized a substantial portion of the estimated loss to the Fund associated with First Republic Bank as part of the $16.4 billion in loss provisions recorded for first quarter 2023. As a result, the $2.0 billion in loss provisions recorded for second quarter 2023 is considerably below the expected loss for that institution.” Due to the recent losses, the FDIC is working to rebuild the DIF reserve ratio to its 1.35% statutory minimum by September 2028.

CERTIFICATES OF DEPOSIT

Below are some of the highest CD rates (annual percentage yield - APY) available nationwide, sorted by maturities from three months to five years. You can click here to check if a bank is FDIC insured. In addition, you can click on the institution name in the CD list below to go directly to the bank’s website for more information regarding CD purchase minimums, etc. We always recommend individual CD purchases be limited to within the $250,000 FDIC insurance limit.

Vanguard Federal Money Market (VMFXX) currently offers a 7-day Yield of 5.28% and a compound yield of 5.41%.

3-months:

TotalDirectBank 5.36%

iGoBanking 5.35%

6-months:

TotalDirectBank 5.56%

NexBank 5.50%

Bank5 Connect 5.50%

12-months:

TotalDirectBank 5.65%

NexBank 5.60%

Popular Direct 5.55%

18-months:

Limelight Bank 5.60%

The Federal Savings Bank 5.45%

Popular Direct 5.35%

2-years:

Merrick Bank 5.15%

The Federal Savings Bank 5.00%

MySavingsDirect 5.00%

3-years:

MySavingsDirect 5.00%

DollarSavingsDirect 5.00%

PopularDirect 4.75%

4-years:

iGoBanking 4.75%

First Internet Bank 4.54%

5-years:

PopularDirect 4.65%

First Internet Bank 4.59%

Reminder: The Federal Open Market Committee (FOMC) meeting is this week with a monetary policy decision announcement on Wednesday, September 20th. We do not expect any change in the federal funds rate at this week’s meeting.