Treasury Auctions, CD Rates, and LEI

Leading Economic Index fell 0.3% in March

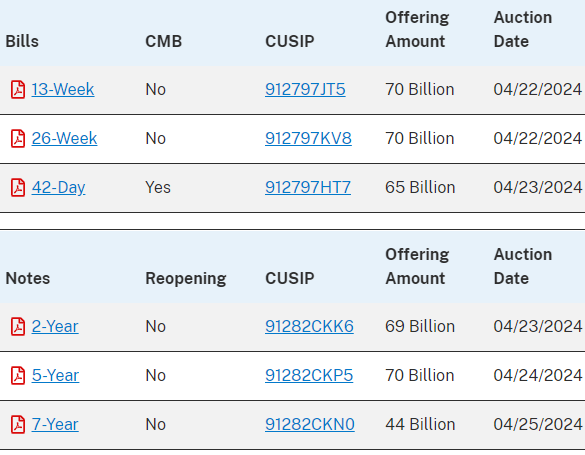

U.S. Treasury has the following schedule of upcoming auctions. Investors can purchase treasuries at no cost using the TreasuryDirect.gov website or at most major brokerages including Vanguard, Fidelity, and Schwab.

BILLS & NOTES

Floating Rate Notes (FRNs)

MONEY MARKET & CD RATES

Below are some of the most attractive money market yields and CD rates available nationwide, sorted by maturities from three months to five years. You can click here to check if a bank is FDIC-insured. In addition, you can click on the institution name in the list below to go directly to the bank’s website for more information regarding CD purchase minimums, etc. We always recommend individual CD purchases be limited to within the $250,000 FDIC insurance limit.

Money Market Funds:

Vanguard Municipal Money Market Fund 3.64% (tax-exempt)

CDs

3-months:

Shoreham Bank 5.50%

TotalDirectBank 5.42%

Popular Direct 5.30%

6-months:

My eBanc 5.49% (jumbo $50k minimum)

TotalDirectBank 5.45%

Flagstar Bank 5.50% (7-months)

MyBankingDirect 5.50% (5-months)

12-months:

My eBanc 5.41% (jumbo $50k minimum)

NexBank 5.40%

TotalDirectBank 5.35%

18-months:

First Internet Bank 5.04%

Lending Club 5.00%

My eBanc 5.00% (jumbo $50k minimum)

Northern Bank Direct 5.40% 15-months

2-years:

My eBanc 4.85%

First Internet Bank 4.82%

NexBank 4.80%

3-years:

DollarSavingsDirect 5.00%

First Internet Bank 4.66%

4-years:

BMO Alto 4.50%

First Internet Bank 4.50%

5-years:

First Internet Bank 4.55%

BMO Alto 4.50%

Reminder: The next Federal Open Market Committee (FOMC) meeting is scheduled for April 30th and May 1st. We do not expect any change in the federal funds rate at the May 1st FOMC meeting.

MUNICIPAL BOND AUCTIONS

Below is a list of the largest upcoming municipal bond offerings:

Source: EMMA

LEADING ECONOMIC INDICATORS :: MARCH 2024

The Conference Board Leading Economic Index (LEI) fell 0.3% in March, following a 0.2% increase in February. Over the six months from September 2023 to March 2024, the LEI contracted by 2.2%, an improvement from the 3.4% decline in the previous six-month period. The diffusion index was 50, with five of ten LEI components positive in March.

“The Conference Board forecasts GDP growth to cool after the rapid expansion in the second half of 2023. As consumer spending slows, US GDP growth is expected to moderate over Q2 and Q3 of this year.”

-Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board

Source: The Conference Board

Source: The Conference Board

The Coincident Economic Index® (CEI), which gauges present economic conditions, increased by 0.3% in March, following a 0.1% increase in February. During the six-month period from September 2023 to March 2024, the CEI rose 0.6%, down slightly from the 0.9% growth observed in the previous six months. All four CEI components rose in March.

In case you missed it, here is our post on the upcoming Series I Savings Bond inflation rate adjustment, which will take effect on May 1st.