Treasury Auctions, Muni Auctions, and CD Rates Update

The initial Fed rate cut is likely to occur at the September FOMC meeting given the improvement in the incoming inflation figures.

U.S. Treasury has the following schedule of upcoming auctions. Investors can purchase treasuries at no cost using the TreasuryDirect.gov website or at most major brokerages including Vanguard, Fidelity, and Schwab.

BILLS

NOTES

BONDS

Treasury Inflation-Protected Securities (TIPS)

Floating Rate Notes (FRNs)

MONEY MARKET & CD RATES

Below are some of the most attractive money market yields and CD rates available nationwide, sorted by maturities from three months to five years. Click here to see if a bank is FDIC-insured. You can click on the institution name in the list below to go directly to the bank’s website for more information regarding CD purchase minimums, etc. We always recommend individual CD purchases be limited to within the $250,000 FDIC insurance limit.

Money Market Funds:

Vanguard Municipal Money Market Fund 2.63% (tax-exempt)

CDs

3-months:

TotalDirectBank 5.51%

Shoreham Bank 5.50%

Quontic Bank 5.50%

6-months:

TotalDirectBank 5.51%

My Banking Direct 5.50% (5-months)

My eBanc 5.45% ($50k minimum)

12-months:

NexBank 5.40%

My eBanc 5.38% ($50k minimum)

TotalDirectBank 5.35%

18-months:

M.Y. Safra Bank 5.10%

The Federal Savings Bank 5.05%

Lending Club 5.00%

2-years:

Able Banking 4.95%

Crescent Bank 4.90%

My eBanc 4.85%

3-years:

DollarSavingsDirect 5.00%

Crescent Bank 4.80%

M.Y. Safra Bank 4.70%

4-years:

BMO Alto 4.70%

The Federal Savings Bank 4.55%

5-years:

BMO Alto 4.75%

First Internet Bank 4.50%

MUNICIPAL BOND AUCTIONS

Below is a list of the largest upcoming municipal bond offerings nationwide:

Source: EMMA

CONSUMER PRICE INDEX

The June 2024 consumer price index (CPI) report showed the second consecutive month of disinflation following four months of higher-than-expected readings. The better CPI numbers make a September FOMC rate cut increasingly likely.

The CPI report showed that the inflation index rose 3.0% year over year through June 2024. The core CPI, which excludes the volatile food and energy components, rose 3.3% year over year.

Headline CPI:

-0.1% seasonally adjusted in June, following 0.0% in May

+3.0% year-over-year

Core CPI: (excludes food and energy)

+0.1% seasonally adjusted in June, following +0.2% in May

+3.3% year-over-year

In case you missed it, here is our July 2024 Model Portfolio Update.

The next FOMC meeting is scheduled for July 30th and 31st. No change in monetary policy is expected at the July meeting.

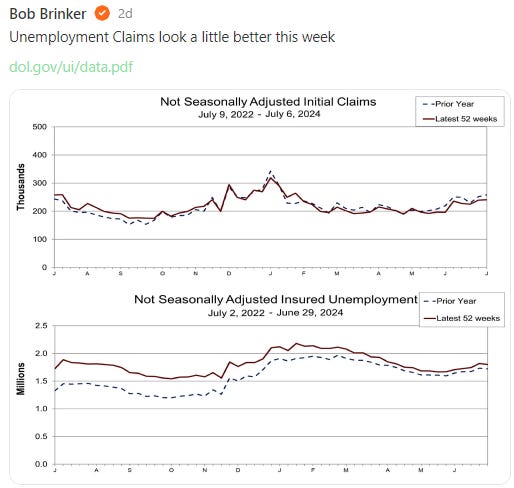

In between our regular BrinkerAdvisor posts you receive via email, we occasionally publish short notes on our website. You can read our notes anytime at BrinkerAdvisor.com/notes. (Example below)