Weekend Update

"You can observe a lot by just watching." -Yogi Berra

The ASA Staffing Index is showing signs of stabilizing despite some weakness earlier this year. Staffing Index jobs are down -5.9% year-over-year taking the average over the four weeks ending June 11th. The Staffing Index has been moving sideways in recent weeks.

Unemployment insurance claims have moved higher in recent weeks, but it remains to be seen if this is a trend change or just another bout of state-level fraud temporarily showing up in the jobless claims data. We should know the answer in the next few weeks.

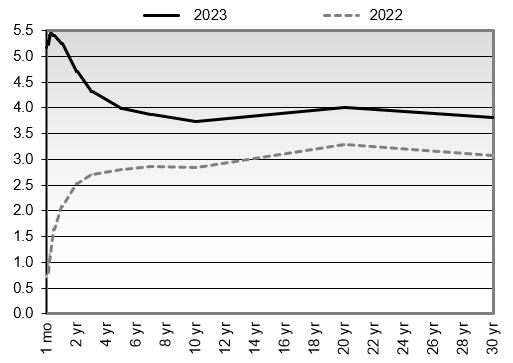

The U.S. Treasury Yield Curve remains inverted. We view maturities in the one-month through two-year range as attractive for purchase. Below are a few of the key UST Yield Curve spreads we monitor. All three of these yield curve spreads are inverted.

30-year vs 3-month is -159 basis points.

10-year vs 2-year is -97 basis points.

10-year vs 3-month is -167 basis points.

This week’s U.S. Treasury Auction Schedule includes bills, 2-year, 5-year, and 7-year notes, and a floating rate note(FRN) reopening:

You can purchase treasury auctions directly at TreasuryDirect.gov or via your brokerage.

This week’s economic calendar:

Monday June 26:

Dallas Fed Survey

Tuesday June 27:

Durable Goods Orders

Consumer Confidence

New Home Sales

Wednesday June 28:

Fed Chair Powell at ECB Forum

Thursday June 29:

Pending Home Sales

Friday June 30:

Chicago PMI

Consumer Sentiment