Weekend Update

"The stock market is never obvious. It is designed to fool most of the people, most of the time." -Jesse Livermore

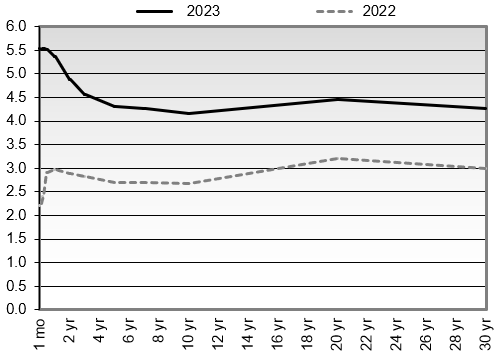

All of our U.S. Treasury Yield Curve measures remain inverted. We view maturities from one month through two years as attractive for purchase. Below are a few of the key UST Yield Curve spreads we monitor. All three of these yield curve spreads are inverted.

30-year vs 3-month is -127 basis points.

10-year vs 2-year is -73 basis points.

10-year vs 3-month is -138 basis points.

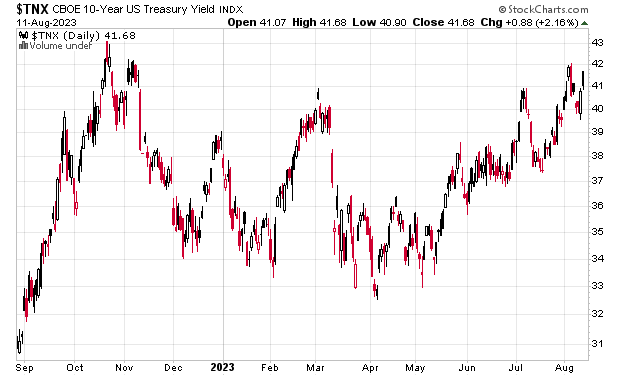

The recent rise in longer-term rates has resulted in the 10-year Treasury yield approaching its October 2022 peak. We will watch this level closely to see if the 10-year yield can close above last year’s highs. It appears ready to do so.

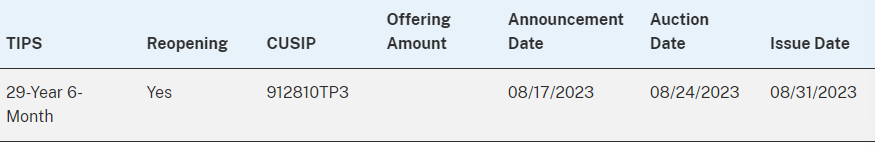

The upcoming U.S. Treasury Auction Schedule includes several bills, a new 20-year bond, a 30-year TIPS reopening, and a 2-year floating rate note(FRN) reopening:

BILLS

BONDS

TIPS

FLOATING RATE NOTES (FRNs)

Floating rate notes(FRNs) are unique in that they are short-term investments that mature in two years, pay interest four times per year (every three months), and the interest rate may change over time. The FRN interest rate is determined as follows:

How we calculate the floating interest rate

The interest rate of an FRN is the sum of two components: an index rate and a spread.

Index rate. This rate is tied to the highest accepted discount rate of the most recent 13-week Treasury bill. We auction the 13-week Treasury bill every week, so the index rate of an FRN is reset every week.

Spread. The spread is a rate we apply to the index rate. The spread stays the same for the life of an FRN. The spread is determined at the auction when the FRN is first offered. The spread is the highest accepted discount margin in that auction.

The index rate plus the spread equals the interest rate.

Source: TreasuryDirect.gov

You can purchase treasury auctions directly at TreasuryDirect.gov or via your brokerage.

This week’s notable economic data:

Tuesday, August 15:

Retail Sales

NAHB/Wells Fargo Housing Market Index (HMI)

Wednesday, August 16:

Industrial Production

Thursday, August 17:

The Federal Open Market Committee (FOMC) has three meetings remaining in 2023 on September 19th/20th, October 31st/November 1st, and December 12th/13th. The Fed will publish an updated Summary of Economic Projections at the September and December FOMC meetings. Last week’s consumer price index(CPI) report showed the disinflationary trend continues. The monthly headline and core CPI measures were 0.2% in July, the same as in June. As of this writing, we expect the Fed will “skip” a rate increase at the September meeting, but we still have a month of incoming economic data to consider.

Hey Bob,

It looks like MX is at another low for the year. Do you see this as a buying opportunity?

Hello Bob, I have studied your portfolios designed for fixed income returns and have a question. I noticed that DLTNX, which is in all three portfolios, has a duration of 6.31 years. If we get to the point where the feds start to reduce interest rates, does it make sense to hold longer duration bond funds like this because they will increase in value? I realize the reverse is true from your reminder about duration in each portfolio description. Thanks!