FOMC Meeting and Leading Economic Indicators

"I guess I should warn you, if I turn out to be particularly clear, you've probably misunderstood what I said." -Alan Greenspan

FEDERAL OPEN MARKET COMMITTEE :: MARCH 2024

The Federal Open Market Committee (FOMC) held a two-day meeting on March 19th and 20th. FOMC members voted unanimously to keep the federal funds rate at the 5.25% to 5.5% target range and to continue the quantitative tightening program that reduces the Fed’s balance sheet at a pace of up to $95 billion per month. Below is the post-meeting FOMC statement:

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Thomas I. Barkin; Michael S. Barr; Raphael W. Bostic; Michelle W. Bowman; Lisa D. Cook; Mary C. Daly; Philip N. Jefferson; Adriana D. Kugler; Loretta J. Mester; and Christopher J. Waller.

The March FOMC meeting allowed committee members to share their latest economic projections. The table below shows the latest figures and the prior (December) figures using the projections’ central tendency, which excludes the three highest and three lowest projections for each variable each year. As you can see, the forecast for 2024 real GDP growth is notably higher, the unemployment rate is slightly lower, and the inflation rate is slightly higher. The Fed’s rate projection for December 2024 was raised slightly to a range of 4.6% to 5.1% and 3.4% to 4.1% in December 2025. This translates into a forecast of two or three rate cuts during the six remaining FOMC meetings scheduled this year between May 1st and December 18th.

The “dot plot” shows each FOMC member’s rate forecast for December 2024, December 2025, and over the longer term. Below is the March dot plot. As you can see, fourteen FOMC members expect two or three rate cuts over the next nine months.

Following the March FOMC meeting, the CME FedWatch meeting probabilities still leaned toward the initial rate cut occurring at the June FOMC meeting.

Below is a video and transcript of Fed Chair Powell’s media conference:

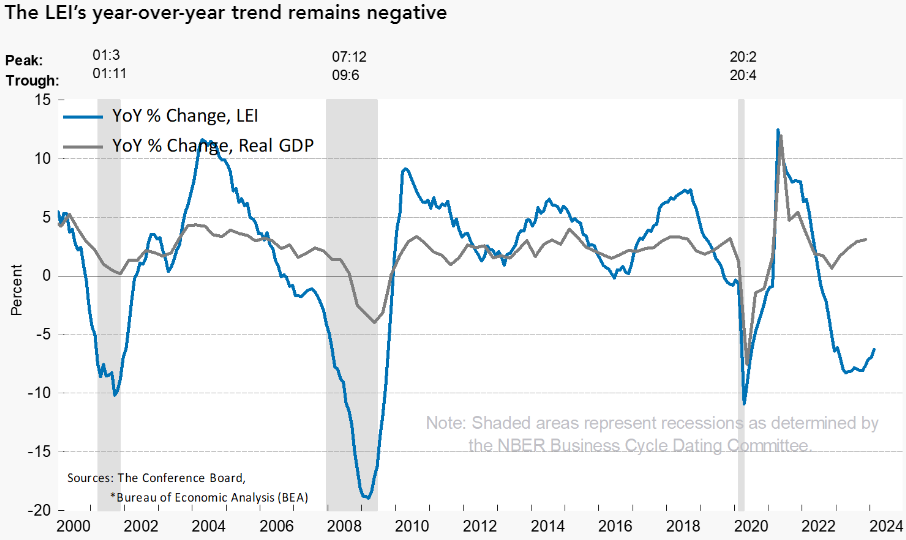

LEADING ECONOMIC INDICATORS :: FEBRUARY 2024

The Conference Board Leading Economic Index® (LEI) increased 0.1% in February, following a 0.4% decline in January. Over the six months from August 2023 to February 2024, the LEI contracted by 2.6%, an improvement from the 3.8% decline in the previous six-month period. This was the first increase in the LEI in two years. Seven of the ten LEI components were positive in February.

“Despite February’s increase, the Index still suggests some headwinds to growth going forward. The Conference Board expects annualized US GDP growth to slow over the Q2 to Q3 2024 period, as rising consumer debt and elevated interest rates weigh on consumer spending.”

-Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board

Source: The Conference Board

Source: The Conference Board

The Coincident Economic Index® (CEI), which gauges present economic conditions, increased by 0.2% in February, following a 0.1% increase in January. During the six-month period from August 2023 to February 2024, the CEI rose 1.1%, up from the 0.8% growth observed in the previous six months. All four CEI components rose in February.

In case you missed it, last week we posted our favorite money market and CD rates.

Our Model Portfolio Update for April 2024 will be published the weekend of March 31st. Here is our March Model Portfolio Update.