Leading Economic Indicators

July 2023 Update

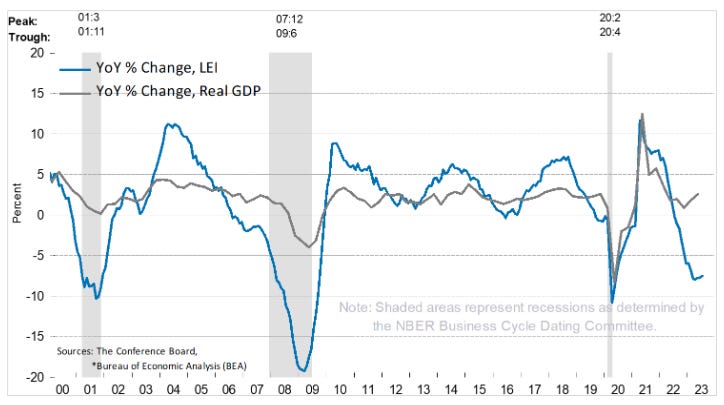

In July 2023, the Conference Board Leading Economic Index® (LEI) fell 0.4%, following a 0.7% decline in June. July marked the sixteenth consecutive decline in the index. Three of the ten LEI indicators made a positive contribution: 1) the S&P 500 Index; 2) weekly initial unemployment insurance claims; and 3) manufacturers’ new orders. During the six-month period from January 2023 through July 2023, the LEI declined by 4.0%, slightly faster than the 3.7% drop observed in the previous six-month period.

“The leading index continues to suggest that economic activity is likely to decelerate and descend into mild contraction in the months ahead. The Conference Board now forecasts a short and shallow recession in the Q4 2023 to Q1 2024 timespan."

-Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board

Source: The Conference Board

Source: The Conference Board

The Coincident Economic Index® (CEI), a measure of current economic activity, edged 0.4% higher in July, following a flat 0% reading in June. Looking at the six-month period between January 2023 and July 2023, the CEI rose 0.7%, slightly lower than the 0.9% growth experienced in the preceding six-month period. Strength within the CEI components remained widespread with all four components increasing.

The ongoing recovery in the services economy continues to outweigh the recessionary signals emanating from the goods economy. This is attributed to the dramatic post-COVID shift in consumer spending patterns. The Atlanta Fed GDPNow is estimating third-quarter real GDP growth of 5.8%.

Thanks Bob

Bob do you think inflation and interest rates are causing the recent downturn in the market. You would think the market would have all this factored in?