Model Portfolios | October Update

S&P 500 6688.46 | 10-Year UST Yield 4.15% | September 30, 2025

“The secret to investing is to figure out the value of something – and then pay a lot less.”

COMMENTARY

The S&P 500 achieved a new all-time record high on September 22nd when it closed at 6693.75. Stock market valuations are stretched, with the forward P/E multiple nearing 24 times earnings.

Real GDP is forecast to increase by around 3% in the third quarter, following a 3.8% growth rate in the second quarter. The Atlanta Fed GDPNow model forecasts real GDP growth of 3.9% in Q3. The New York Fed GDP Nowcast model forecasts 2.5% growth in the third quarter. Real GDP increased at an average rate of 1.6% during the first half of 2025, just below our long-term trend growth estimate of 2%.

This month, we will review our favorite real-time economic indicators:

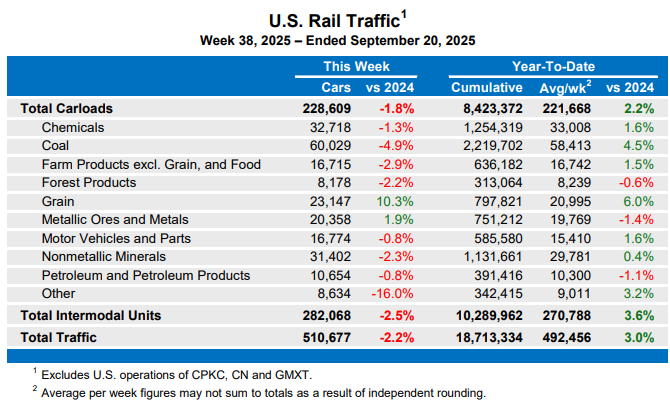

The Association of American Railroads (AAR) reported that total combined rail traffic increased 3.0% through the initial 38 weeks of 2025 compared to last year. The combined rail traffic figure includes cumulative carload volume up 2.2% and intermodal units up 3.6%. In the most recent reporting week ending September 20th, only two of the ten carload commodity groups posted gains compared to the same week last year.

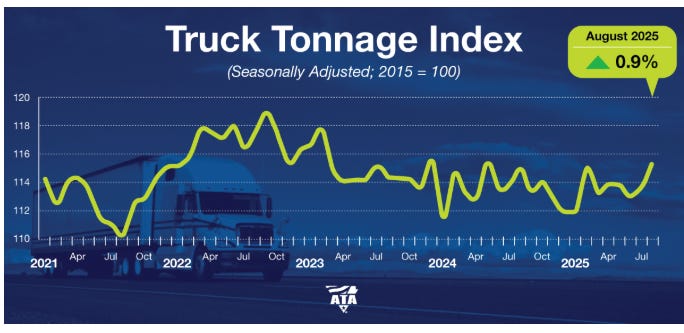

The American Trucking Associations’ Truck Tonnage Index rose 0.9% in August, following a 1.1% increase in July. This lifted the index to its highest level since December 2023. On a year-over-year basis, the index rose 0.4%. The ATA Economist noted that “housing remains soft, the slowing labor market is likely to show up in consumer spending at some point, and most manufacturing metrics are either decelerating or declining.” Trucking is an excellent barometer of economic activity, representing more than 70% of U.S. goods transported.

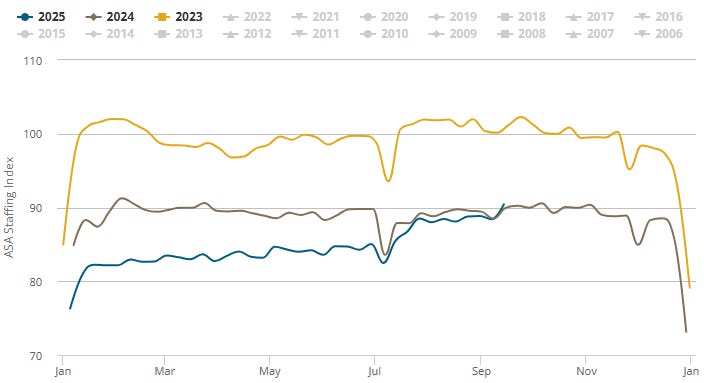

The American Staffing Association (ASA) Staffing Index shows that temporary staffing trends have been improving in recent months. The four-week moving average is roughly flat year-over-year, and it appears the long-term slowdown in temp staffing is almost over. We follow temporary staffing levels because short-term staffing changes typically occur before changes in full-time staffing. The ASA Economist observed that “this trajectory suggests that the longstanding staffing slump may soon be fading into our rearview mirror.”

HOUSING MARKET UPDATE

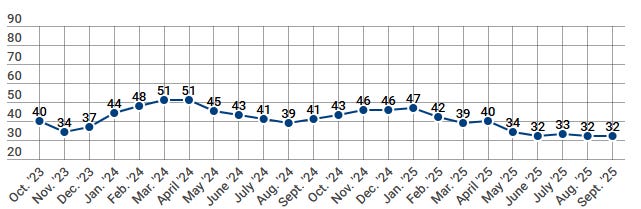

The NAHB/Wells Fargo Housing Market Index (HMI) measures conditions in the single-family housing market. The index was unchanged in September, remaining at a depressed level of 32. HMI Index readings above 50 indicate favorable sentiment among single-family home builders. The current sales conditions index was stable at 34, the measure of sales expectations over the next six months rose two points to 45, and the prospective buyer traffic index declined 1 point to 21. The NAHB Economist noted “the 30-year fixed rate mortgage average is down 23 basis points over the past four weeks to 6.35%, per Freddie Mac. This is the lowest level since mid-October of last year and a positive sign for future housing demand”. Regionally, the Northeast remained the strongest, unchanged at 44. The Midwest rose one point to 42. The South was stable at 29, and the West rose one point to 26.

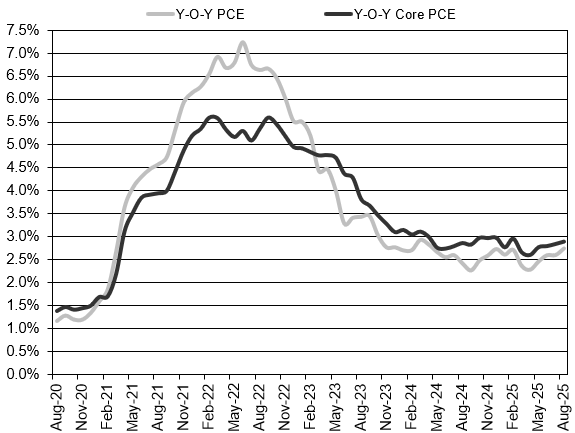

INFLATION UPDATE

The Fed’s preferred inflation measure is the personal consumption expenditures (PCE) price index. In August, the headline PCE inflation rate was 2.7% year-over-year. The core PCE inflation rate, which excludes the volatile food and energy components, was 2.9% year-over-year. The 3-month annualized core PCE inflation rate was 2.9% and the 6-month annualized core PCE inflation rate was 2.5%. Both headline and core inflation rates remain just above the Fed’s 2% inflation target.

Headline PCE:

+0.3% seasonally adjusted in August, following 0.2% in July

+2.7% year-over-year

+2.9% latest 3 months annualized

+2.2% latest 6 months annualized

Core PCE: (excludes food and energy)

+0.2% seasonally adjusted in August, following 0.2% in July

+2.9% year-over-year

+2.9% latest 3 months annualized

+2.5% latest 6 months annualized

FEDERAL RESERVE UPDATE

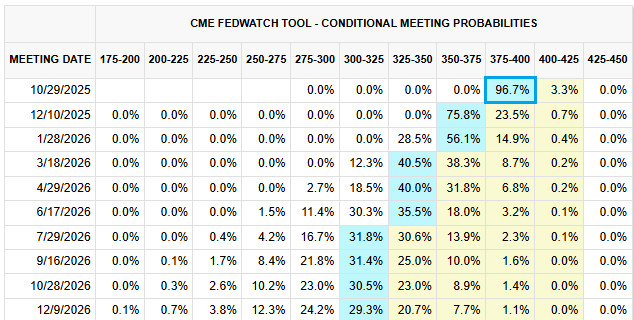

The next FOMC Meeting is scheduled for October 28th and 29th. At the September meeting, FOMC members voted 11-1 to lower the fed funds rate 25 basis points to the target range of 4.00% - 4.25%. The Fed policy statement noted that “indicators suggest that growth of economic activity moderated in the first half of the year. Job gains have slowed, and the unemployment rate has edged up but remains low. Inflation has moved up and remains somewhat elevated.” New Fed Governor Miran was the only vote against the monetary policy decision, in favor of a larger 50 basis point rate cut.

In the September 2025 Summary of Economic Projections, FOMC members lowered the central tendency of their December 2025 fed funds forecast range to 3.6% - 4.1%. This indicates anywhere from zero to two rate cuts over the next three months. As you can see in the table below, real GDP forecasts for 2025 were raised slightly, unemployment rate forecasts held steady, and core inflation forecasts rose a little. Examining the dot plot of individual FOMC members’ rate forecasts, the committee is divided, with seven members forecasting no more rate cuts this year and nine members forecasting two more rate cuts by December.

Following the September FOMC meeting, the CME FedWatch Tool is currently expecting rate cuts at the October and December FOMC meetings. For those rate cuts to occur, FOMC members will need to see further weakening in the labor market data. If the labor market stabilizes or improves from its current level, additional rate cuts are unlikely to occur, with inflation above the 2% target level.

MONEY SUPPLY

MODEL PORTFOLIOS UPDATE

In case you missed it, we made some adjustments to our Marketimer model portfolio weightings in last month’s September Update.

Below is the monthly update of the Marketimer and Brinker Fixed Income Advisor Model Portfolios through September 30, 2025.