Treasuries, CDs, and Munis | November Update

CDs with rates above 4% are still available.

COMMENTARY

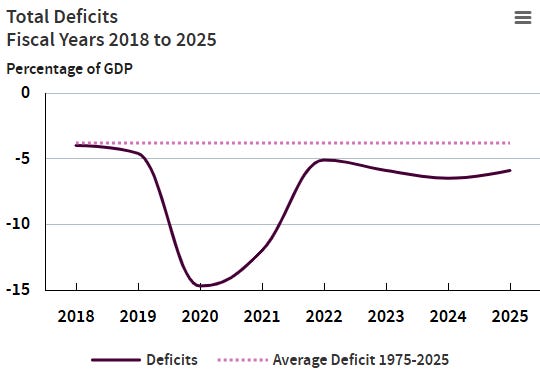

The longest government shutdown in U.S. history (43 days) ended last week after Congress passed a short-term funding bill that funds the federal government through January 30, 2026. According to the Congressional Budget Office (CBO), the federal budget deficit totaled $1.8 trillion in fiscal year 2025, which ended September 30. Receipts increased 6% ($317 billion) while expenditures rose 4% ($275 billion). Total interest on the national debt surpassed $1 trillion for the first time.

U.S. TREASURY AUCTIONS

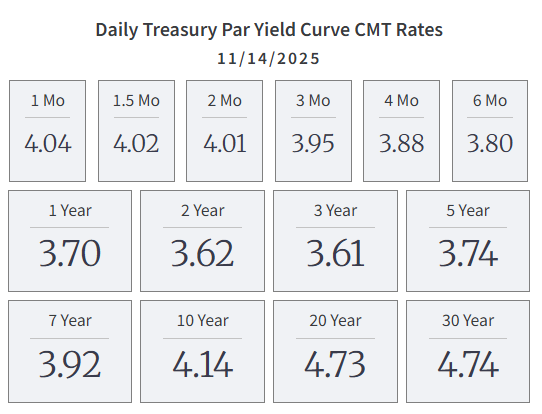

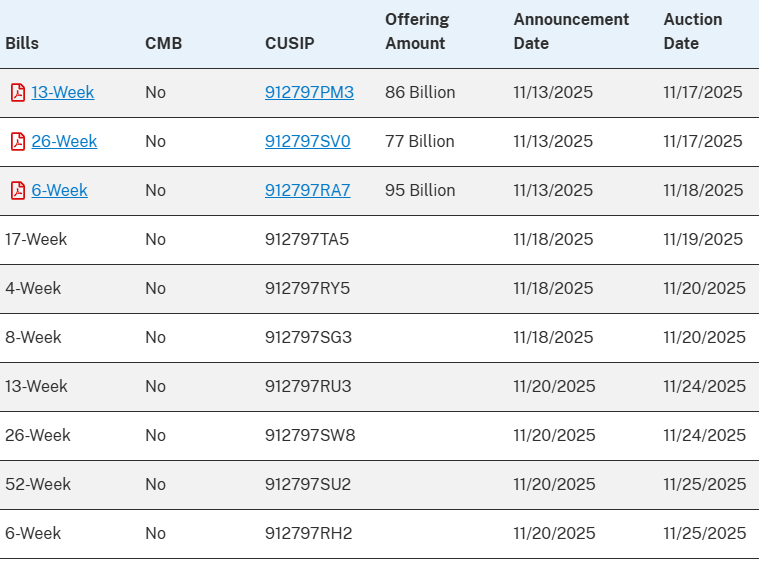

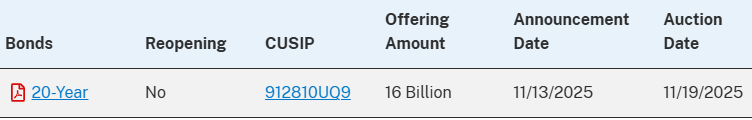

The U.S. Treasury has a full schedule of upcoming auctions. Investors can purchase Treasuries at no cost using the TreasuryDirect.gov website or at most major brokerages, including Vanguard, Fidelity, and Schwab.

BILLS

NOTES

BONDS

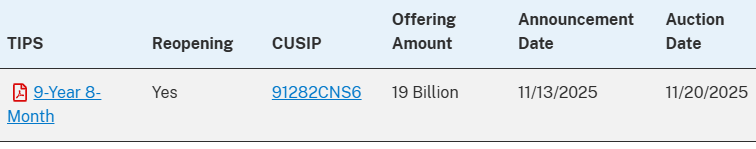

Treasury Inflation-Protected Securities (TIPS)

The current 10-year TIPS yield is 1.83% (+CPI).

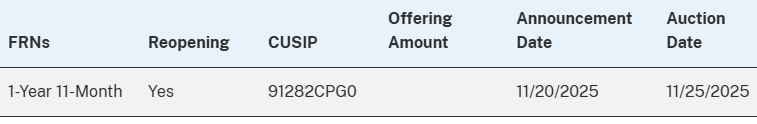

Floating Rate Notes (FRNs)

MONEY MARKET & CD RATES

Below are some of the most attractive money market yields and CD rates available nationwide, sorted by maturities from three months to five years. Click this link to verify that a bank is FDIC-insured. You can click on the institution name in the following list to go directly to the bank’s website for more information regarding CD purchase minimums, etc. We always recommend individual CD purchases be limited to within the $250,000 FDIC insurance limit.

Money Market Funds:

Vanguard Federal Money Market Fund (VMFXX) 3.89%

Vanguard Municipal Money Market Fund (VMSXX) 2.49% (tax-exempt)

Fidelity Money Market Fund (SPRXX) 3.64%

Schwab Value Advantage Money Fund (SWVXX) 3.79%

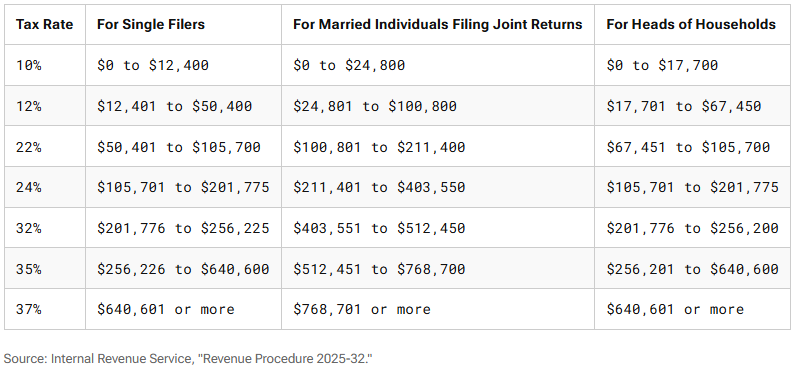

VMFXX has a more attractive tax-equivalent yield than VMSXX for readers in the 35% or lower federal income tax bracket. Below is a tax-equivalent yield comparison of VMFXX versus VMSXX using the 2025 federal income tax brackets:

View the recently published 2026 IRS tax brackets below:

CDs

3-months:

Mutual One Bank 4.13%

Brilliant Bank 4.06%

Ivy Bank 4.00%

6-months:

Mutual One Bank 4.33%

Total Bank 4.25%

Limelight Bank 4.15%

12-months:

Hyperion Bank 4.25% (13-months)

Limelight Bank 4.05%

Total Bank 4.00%

Federal Savings Bank 4.00%

18-months:

Sallie Mae 4.10% (15 months) and 3.95% (18 months)

Brilliant Bank 4.06% (15 months)

Marcus by Goldman Sachs 4.00%

Federal Savings Bank 4.00%

2-years:

Hyperion Bank 4.00%

Federal Savings Bank 4.00%

Marcus by Goldman Sachs 3.95%

3-years:

Federal Savings Bank 3.95%

Sallie Mae 3.90%

Marcus by Goldman Sachs 3.90%

4-years:

Prime Alliance Bank 3.90%

Marcus by Goldman Sachs 3.85%

Federal Savings Bank 3.80%

5-years:

Synchrony Bank 4.00%

Sallie Mae 4.00%

Marcus by Goldman Sachs 3.90%

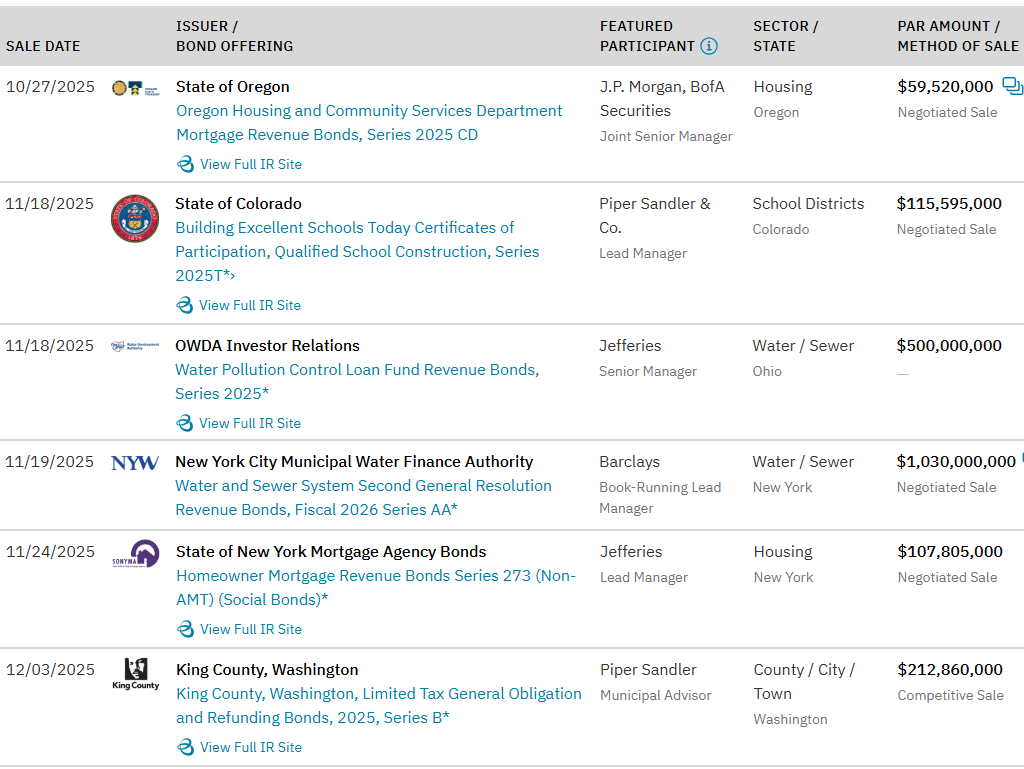

MUNICIPAL BOND AUCTIONS

Read the following list for some of the largest upcoming municipal bond offerings nationwide:

Source: EMMA, BondLink

In case you missed it, here is our Model Portfolio Update published earlier this month.