U.S. Treasury & CD Rates Update

The opportunity to earn a risk-free return of 5% is ending as the Fed embarks on a series of rate cuts this week.

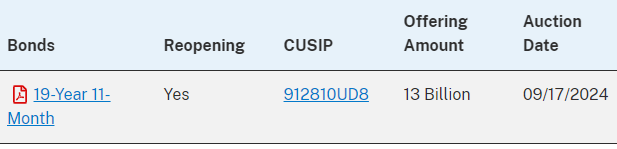

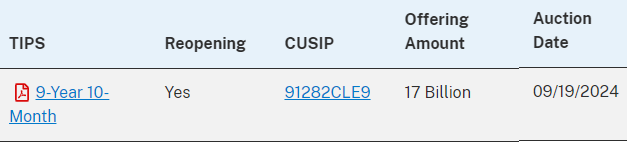

U.S. Treasury has a full schedule of upcoming auctions. Investors can purchase treasuries at no cost using the TreasuryDirect.gov website or at most major brokerages including Vanguard, Fidelity, and Schwab.

BILLS

NOTES

BONDS

Treasury Inflation-Protected Securities (TIPS)

Floating Rate Notes (FRNs)

MONEY MARKET & CD RATES

Below are some of the most attractive money market yields and CD rates available nationwide, sorted by maturities from three months to five years. Click here to see if a bank is FDIC-insured. You can click on the institution name in the list below to go directly to the bank’s website for more information regarding CD purchase minimums, etc. We always recommend individual CD purchases be limited to within the $250,000 FDIC insurance limit.

Money Market Funds:

Vanguard Municipal Money Market Fund 3.65% (tax-exempt)

CDs

3-months:

Shoreham Bank 5.50%

Mutual One Bank 5.40%

Total Bank 5.15%

6-months:

My eBanc 5.30% ($50k minimum)

Mutual One Bank 5.25%

AloStar Bank 5.25% (5-month)

12-months:

My eBanc 5.15% ($50k minimum)

LendingClub 5.10% (10-month)

Limelight Bank 5.00%

18-months:

Sallie Mae Bank 4.75% (15-month)

Lending Club 4.75%

Limelight Bank 4.75%

2-years:

Lending Club 4.50%

My eBanc 4.50% ($50k minimum)

The Federal Savings Bank 4.45%

3-years:

The Federal Savings Bank 4.25%

Shoreham Bank 4.25%

First Internet Bank 4.19%

4-years:

Shoreham Bank 4.25%

The Federal Savings Bank 4.15%

First Internet Bank 4.03%

5-years:

Shoreham Bank 4.25%

First Internet Bank 4.09%

The Federal Savings Bank 4.05%

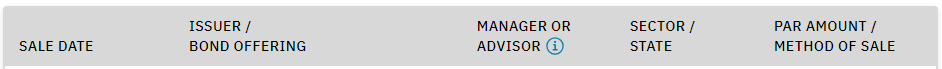

MUNICIPAL BOND AUCTIONS

Below is a list of some of the largest upcoming municipal bond offerings nationwide:

Source: EMMA, BondLink

FEDERAL OPEN MARKET COMMITTEE (FOMC) MEETING PREVIEW

The FOMC meets this week with a monetary policy decision announcement coming on Wednesday, September 18th. Although there is a 100% probability of a rate cut this week, investors are evenly split on the size of the cut, with 50% anticipating a 25 basis point cut and 50% anticipating a 50 basis point cut, according to the CME FedWatch Tool. This week’s Fed meeting will also include an updated Summary of Economic Projections (SEP).

We think that either a 25 or a 50 basis point rate cut decision is defensible, and Chair Powell made it clear in his Jackson Hole speech that the pace and timing of rate cuts would be determined by the incoming data. So far, the data has been mixed. Since Chair Powell’s August 23rd speech, inflation readings have been in line, indicating the disinflationary trend remains intact and the Fed is close to achieving its 2% inflation target. The labor market indicators have also been in line with forecasts, though it is clear that weakness in the labor market is a growing concern to FOMC members.

It is important to remember that as the pace of inflation slows, the real level of interest rates increases, which is de facto policy tightening. Therefore, Chair Powell could lean into the argument that a larger 50 basis point cut is warranted. On the other hand, the unemployment rate is just 4.2% and it dipped slightly in the most recent jobs report. In addition, the third quarter GDPNow forecast is showing 2.5% real GDP growth, slightly above our long-term 2% trend estimate. Solid GDP growth may be the best argument against a 50 basis point rate cut this week.

Regardless of the size of this week’s rate cut, the Fed is only beginning what will ultimately be a series of rate cuts over the coming months. Fed Gov. Waller recently noted in a speech, “I do not expect this first cut to be the last.” We also think there may be a few FOMC members who would prefer to delay more significant rate cuts until after the upcoming November 5th election. Conveniently, the FOMC is scheduled to meet on November 6th and 7th, and there is a possibility we will know the election results prior to the policy decision announcement.

In case you missed it, here is our September 2024 Model Portfolio Update.

Below is our Note posted on the day of the Consumer Price Index report. Overall, it was a good CPI report, although the core CPI figure was slightly higher than expected.