Leading Economic Indicators

In June, the Leading Economic Index dropped 0.2% and the Coincident Economic Index rose 0.3%.

LEADING ECONOMIC INDICATORS :: JUNE 2024

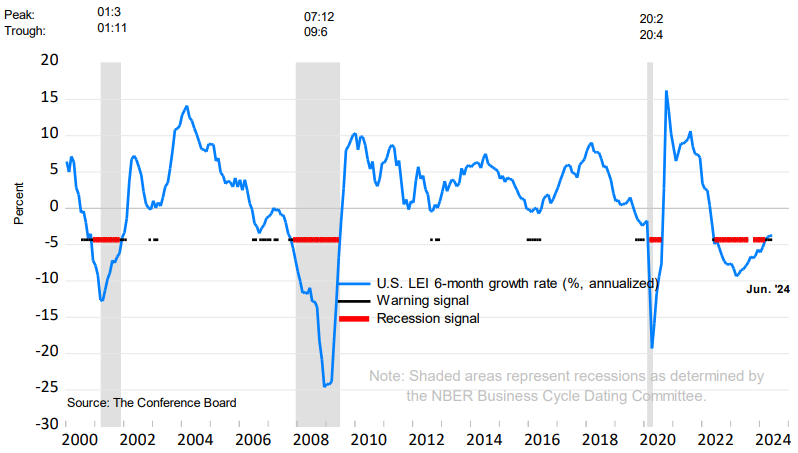

The Conference Board Leading Economic Index® (LEI) decreased by 0.2% in June 2024, following a 0.4% decline in May. For the first half of 2024 (January through June), the LEI contracted by 1.9%, showing improvement compared to the 2.9% decline observed in the second half of 2023. While the LEI continues to decrease, the rate of decline is slowing. Despite this ongoing contraction, The Conference Board forecasts slow economic growth rather than a recession. Current GDP growth projections for the second quarter of 2024 vary: the Atlanta Fed's GDPNow model estimates 2.7% real GDP growth, while the New York Fed's Nowcast predicts 2.0% growth.

“June’s data suggest that economic activity is likely to continue to lose momentum in the months ahead. We currently forecast that cooling consumer spending will push US GDP growth down to around 1 percent (annualized) in Q3 of this year.”

-Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board

Source: The Conference Board

Source: The Conference Board

The Coincident Economic Index® (CEI), which gauges present economic conditions, increased by 0.3% in June, down slightly from a 0.4% increase in May. From January through June 2024, the CEI rose 0.6%, slower than the 1.3% growth rate observed in the previous six months. All four CEI components rose in June.

NOTES

The Federal Open Market Committee (FOMC) meets on July 30th and 31st. We do not expect any monetary policy change at the July meeting. We do think Fed Chair Powell is likely to lay the groundwork for an initial September rate cut, so long as the incoming inflation data continues to cooperate.

U.S. Treasury has a busy week of auctions scheduled including 2, 5, and 7 year notes on Tuesday, Wednesday and Thursday.

According to Factset, the second quarter earnings reports have been mixed. The forward P/E ratio remains elevated at just over 21. The upcoming week will provide a clearer picture of S&P 500 earnings with 138 companies reporting.

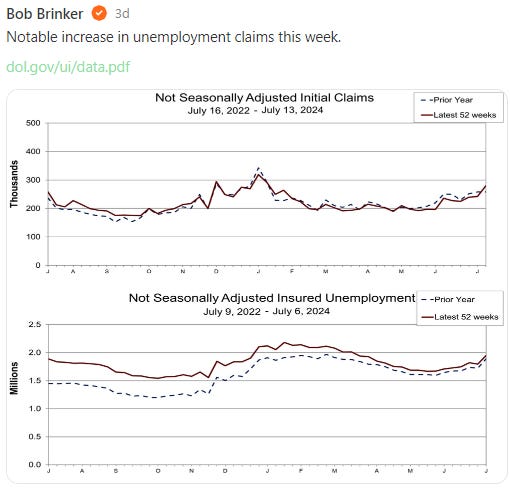

Unemployment claims ticked higher last week, which we are monitoring closely. The increase appears to be attributable to Hurricane Beryl’s impact on Texas.

In case you missed it, we posted our favorite money market and CD rates last weekend. The 5.29% yield in VMFXX remains very attractive. (5.42% compound yield).